Time’s Up! Paying for College

Lately, I’ve had a number of clients and prospects ask how to pay for college. Not in the future – but RIGHT NOW. They’re past

Lately, I’ve had a number of clients and prospects ask how to pay for college. Not in the future – but RIGHT NOW. They’re past

Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what happens to most such self-promises, so here’s a month-by-month to-do list to cultivate better financial health.

With the CARES Act expiring in January 2022, many will be asked to resume student loan payments – but can they afford to pay?

Will cash app and marketplace transactions be reported to the IRS? For many more than ever before – yes!

Keep the kids busy this Thanksgiving! Enjoy this coloring page that can decorate your table.

Have you seen a Roth option available in your 401(k)? Read on to help determine if it’s the right option for you.

Social Security benefits for millions of Americans will increase 5.9% in 2022. Taxable wage maximum for SS tax increases to $147k.

Open enrollment is here, so as I offer every year, here is my latest recap that goes over the different Medicare Part/Plan options and their

Will cash deposits above $600 soon be reported to the IRS? Technically no, but for some effectively yes.

Medicare enrollment is happening NOW! Connect with a Medicare enrollment expert to review your Supplement, Part D or Advantage plan. Even if your health and

SECURE Act 2.0 focuses on incentivizing people to save more for retirement. But will it be passed?

Given the average cost of a COVID-19 hospitalization in 2020 ran about $42,200 per patient, will the unvaccinated be asked to bear more of the cost of treatment, in terms of insurance, as well?

While the checklists grow and the kids soak in the last few minutes of summer break, it’s important to remember college planning and back-to-school shopping.

Your office may be reopening and you’re in a position to secure and afford child care. The Balance does a great job explaining care options.

Charitable donations create charitable deductions which dollar-for-dollar reduce your taxable income. Special legislation in 2020 and 2021 benefits even those taking a Standard Deduction.

POWWOW, LLC was recently featured by Linda Lecomte, REALTOR® in her new Andover-area inspired website and newsletter Shop Dine the Andovers.

Ask yourself three questions before you use actual dollars to buy cryptos In very simple terms, there are three main asset classes: equities (stocks), fixed-income

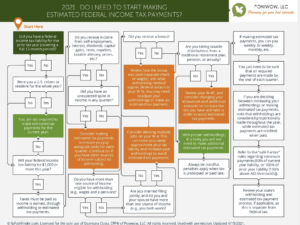

Passive income can unintentionally cause tax penalties for late or underpayments. This is avoidable by making estimated tax payments.

Federal student loan payments and collections are set to resume in October 2021. There is a chance that the pause may be extended or a ramp-up plan will be put in place.

There is so much chatter about inflation impacting the stock market – not to mention gas, lumber and chlorine skyrocketing in price, what’s the deal? Here’s a primer.

Health Savings Accounts are a tax-trifecta savings vehicle that are often overlooked due to bias against the less popular Flex Savings Accounts.

It’s officially Spring, and your closet may not be the only thing that needs a good clean-out. What about your financial habits? Watch my video on how to fix up your finances.

Acceptance letters are rolling in and it’s time to make a decision on college. If your top pick is more expensive than the rest… ask for more aid. Here’s how from Student Loan Hero…

On April 13, Quentara will review what to consider financially when assessing care options and how to increase your chances of retaining independence. Via Zoom. RSVP here.

65% of people with long-term care needs rely exclusively on family and friends to provide assistance. What’s your plan in the event aging loved ones didn’t fair well during COVID?

President Biden’s $1.9 trillion stimulus package cleared its final hurdle in Congress on Wednesday despite no Republicans voting in favor of it. The plan contains a range of measures such as a further direct round of payments to most Americans, amounting to more than $400 billion.

We can get tunnel vision when it comes to following “Rules of Thumb.” I dare you to push back when it comes to maxing out 529 Plans and 401(k)s.

There is a ton to consider as you decide on the right college. Make sure you’ve considered all your options and resources.

When receiving treatment options for a diagnosis, learn when you may want to reach out to a doctor vs a health advocate.

Embark on a brighter future with our comprehensive guide on getting financial aid for private schools.

The 2020 performance for the major U.S. indices was nothing short of impressive, especially given the headwinds of COVID-19 and the drama surrounding the presidential election.

News Years Resolutions – In bite size pieces Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what

The holidays are here as we struggle to find a balance between safe and sane during COVID-19, all while our children are watching. Here is some great tips from pediatricians on how to keep calm and carry-on.

Commonplace strategies for helping an aging parent can blow up in your face if you have a college-bound child. Read how.

The holidays are here as we struggle to find balance between safe and sane during COVID-19. Your children are likely looking forward to the normalcy of holiday tradition,

Read about how tax planning opportunities could change in the coming years due to the upcoming election.

Halloween is my favorite time of year because it offers certain qualities other holidays lack: It’s an opportunity to be creative and try a new

Effective ways to reduce credit card debt If you have a lot of credit card debt on your shoulder, consolidating them into one affordable repayment

One extracurricular activity that every student can master while in college is personal money management. Typically, a student’s daily spending is done on an improvised

Everyone is asking – how will my goals be impacted by the upcoming election? When it comes to the stock market, elections matter less than

If you’re worried about downsizing your home, you really shouldn’t be. While finding the right home for your budget and planning a move can feel

Even if you’re not providing hands-on physical care for an aging parent, you’re still likely spending a ton of time in a project management role.

The coronavirus is bringing waves of changes to how we approach everyday tasks and traditions. The same will be true for college admissions. While colleges

Your checking account is at an all time high and you’re eager to do something more with your money. Anything has to be better than

I’ve recently had some questions about consolidating credit card debt. These questions usually come from clients who have 5+ cards or consumer loans with outstanding

Apart from stimulus checks, small business loans, and expanded unemployment, there are a few “hidden gems” sprinkled throughout the CARES Act that are worth noting.

The U.S. Department of the Treasury is delaying the April 15th deadline to file and pay taxes by 90 days, giving individuals and businesses another

Student loan debt presents a serious financial burden for countless graduates. Even the XY Generation (you?) is struggling to earn enough money to take care

If you’re related to a loved one in the hospital, rehab or living in a retirement community, you may have received a message by now

What’s happening? The last couple weeks have certainly been rough on everyone. Stock markets across the world have been on a downward spiral with bouts

I recently read Being Mortal by Atul Gawande, MD. His insight perfectly blends medicine and emotion when it comes to the inevitable challenges of aging.

If you are in a cash crunch, you might consider taking out a 401(k) loan. But before you do, you should know the rules and

The SECURE Act was signed into law on December 20, 2019. Many changes were made that will materially impact retirees, 401(k) plans, and families. So

As a veteran you may feel like you’re participating in an Easter egg hunt to find all your benefits. This may be because most state

A fellow blogger liked my approach to personal finance by making S.M.A.R.T goals. Read how she implemented this into her life and own blog! https://doingthingsdifferent.net/saving-money-think-s-m-a-r-t/

The deadline for the 2019-2020 FAFSA is midnight, June 30, 2020. The earlier you file, the more grant money you are likely to receive (up to

My husband and I have had the fortune (or maybe misfortune?) of being involved in a number of personal real estate transactions. From inherited, residential,

As a Certified Financial Planner™ specializing in elder care I am asked this question daily. Unfortunately, all too often the family’s immediate reaction is that

It’s important to understand the fine print of your home equity line of credit (HELOC). Make sure not to get swept up in your plans

While success can be defined in a multitude of ways, most boil down to one simple desire – financial freedom. So what happens when a

It’s your birthday, and mom, age 81, gives you a call. After pleasantries, she mentions how short-tempered your brother has been. She appreciates his help

This year I had many families and small business owners asking for CPA recommendations. Surprisingly, the recent tax code changes that were meant to simplify

Negotiating is a critical life skill to master, but yet it’s largely untaught in a traditional school setting. We encounter negotiating everyday. Whether closing a

Whenever I discuss elder care I can count on being asked one question… “What if I run out of money?” Long-term elder care solutions come

Fantasizing that the money will somehow appear isn’t helpful. Here’s what is.

Did you feel attacked at your last family get-together from the mere mention of your intent to pay or not pay for your child’s first

Whether it’s alcohol, cigarettes or junk food, we all indulge in something we know we probably shouldn’t.

Maybe you have an idea of when you’d like to buy your first home or retire from the workforce. But just how realistic are your

The idea of retirement conjures different lifestyle images and meanings for any given person. While some are counting down the minutes to completing their final

Today, roughly one in five women in the United States do not have children. For the first time in U.S. history there may soon be

Does working alongside your contractor help or hurt? Renovations are something most home owners endure either by choice or necessity. Due to lack of skill and/or

Make sure your child is aware of the process to receive support for their learning disability in college I recently met Marylee Palmer of By

Because of the generous capital gains exclusion on selling a primary residence, you may find that you do not owe Federal taxes when it comes

“85% of parents expect their child to graduate with debt, estimating an average of $45,000 in student loans” according to a Fidelity survey. In one

“I can’t hear you… LALALALALALALALALALALA” I recently presented on elder care to seemingly dissimilar groups. Despite their backgrounds, they all had the common bond of

As my husband rolled coins the other day he started muttering about the value of wheat pennies and who’s actually buying these as collectibles. I start

Is it just me, or does making a bed instantly provide a feeling of accomplishment? For me, it doesn’t have to be perfect (far from

Adjusted Gross Income (AGI) Gross Income (Salary, Investment Earnings, etc.) – Allowable Deductions, Credits, and Exemptions =Adjusted Gross Income The goal is to reduce

Powwow, LLC was interviewed by Mental Floss to discuss common client mis-steps. The article positioned my response as being “annoyed” by my clients’ indiscretions. This

CD interest rates can be higher than a typical checking or savings account and are affected by these factors.

Feeling insecure in your ability to banter on about politics, taxes, and headline news the next time you sit down with family and friends? I

During the recent holiday season I was peppered with advertising promoting the idea of gifting DNA and ancestry kits. I’ll admit it, I’m terrible at

Inspired by a question in the North Andover Mom’s Facebook Group! As a business grows from a hobby or planned venture, it’s important to put

Q: My aging parent has a will naming me executor, isn’t that enough for me to take control now? A: No, your parent’s will comes

If there’s anything as disconcerting as having the Internal Revenue Service (IRS) call you about a problem, it’s having to call them. Most people don’t

A credit check for credit cards… When you apply for a credit card you are required to fill out a credit history. The analysis of

Quentara Costa visited Bayberry at Emerald Court alongside Patrick Curley of Curley Law Firm in Wakefield, MA to discuss elder care planning. Quentara addressed “The

“The person you named 10 years ago to be your power of attorney isn’t necessarily the correct fit for today and could be the wrong

Powwow, LLC was interviewed by CBS MoneyWatch to discuss how home equity can be utilized for retirement. In my years of planning I’ve typically seen

Five things to consider before financing daycare NerdWallet recently interviewed POWWOW for an article on an issue plaguing most young families – how to afford

… Even from hundreds of miles away! Most of us want to have a role in caretaking our aging loved ones, but many of us

“Making the call [on elder fraud] is simple when the thief isn’t related to the client. But when the miscreant is a child or grandchild,