Do you need hourly financial planning services because you're...

- Unsure what financial strategies apply to you and if you’ve considered everything before making a big decision?

- Experiencing decision paralysis over all the “what-ifs” related to your financial goals?

- Feeling sandwiched from responsibilities related to kids, self and/or aging parents and want someone in your corner?

You're Looking to Achieve

Momentum

When life gets complicated we tend to freeze. Making no decisions appears better than making the wrong one, right? Maybe… but more likely you’re losing valuable time on achieving your goals. Let’s work together to agree on strategic action items so you can start moving forward using hourly financial planning services.

Peace of Mind

Confidence comes from understanding your options and their expected outcomes. We weave together relevant and factual information alongside reasonable assumptions so you can make a better decision. Cut through the noise and get hourly financial planning services.

Awesome! Let’s Powwow.

Flexible Virtual Portal

Collaborative environment so you don’t need to leave home or work for meetings

Track spending and create a budget, adjust as needed

Safely store and share your most important documents in the vault

Easily manage action items and view progress toward goals

The Process

Step 1: Onboard. Review paperwork, pay invoice, and create your new eMoney portal. Start now!

Step 2: Schedule your first Powwow with our convenient virtual calendar.

Step 3: Start your financial journey through collaboration on our eMoney portal and a series of financial powwows where we’ll identify relevant financial strategy and address your what-ifs. Here is generally how the process goes:

First Powwow: What are your goals? What are your resources?

- Cash reserve, retirement planning, and elder care goals

- Lifestyle “what-ifs” (home renovation, travel, career)

- Goals related to financially supporting children

- Goals related to financially supporting parents

This conversation is also an opportunity to discuss the emotional side of finances. We are happy to provide guidance and perspective to make conversation more productive and less contentious. In addition to goals, we will begin a review of provided information related to:

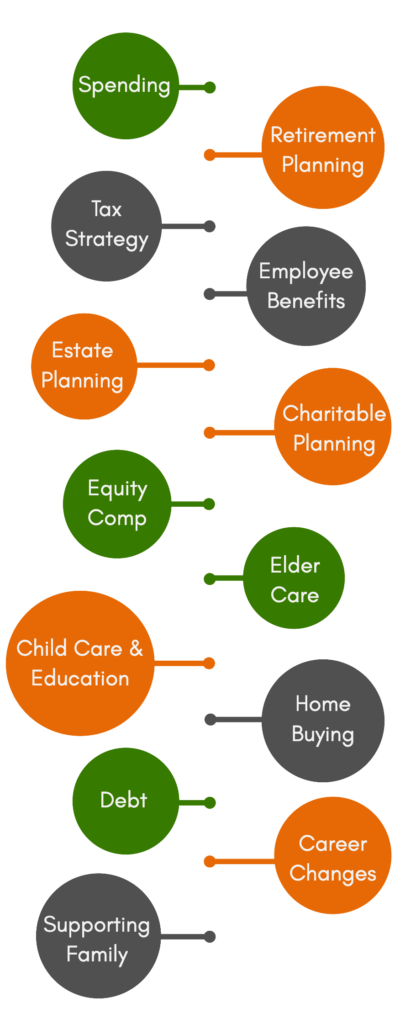

- Spending

- Investment account types, risk tolerance, and allocation

- Estate plans and beneficiary designations

- Tax strategy

- Employee or independent insurance policies (LTC, life, disability)

- Asset protection (home, auto, and liability)

Second Powwow: Visualize options

Third Powwow: Plan delivery

Your plan is complete and we have created a financial plan that illustrates your chosen path with a list of recommendations. After plan delivery, you’ll have access to eMoney for the remainder of the year. If you would like to retain ongoing advisor access in our hourly financial planning services, please ask about our membership program.

FAQs

Our hourly financial planning services require plans to be completed at the client’s pace. This is driven by their availability to provide information and complete powwows. Plans have a minimum of 10 hours and typically take 10-15 hours to complete, although this is just an estimate.

Our hourly financial planning services require project and membership clients to pay a preferred hourly rate of $330. Projects have a minimum of 10 hours. Memberships have a minimum of 8 hours/year. Those not committed to a project or membership pay the hourly rate of $380.

Quentara Costa is a fee-only Certified Financial Planner®. We do not draft estate planning documents, prepare taxes, sell annuities or insurance, or work for community elder service programs. Powwow, LLC is not a health care professional or care provider. If deemed beneficial to pursue advanced strategies, care, or benefits, additional professionals can be hired at the client’s discretion. If local, Quentara can provide recommendations for independent health assessments, attorneys, CPAs, Medicare enrollment, real estate agents specializing in senior downsizing, move managers, handymen, and retirement community locators. National recommendations will be made when possible and with insight from affiliated elder care and financial networks. Quentara does not receive any referral fees or commissions if making a recommendation to a trusted professional.

It is perfectly fine to provide hard copies of requested information. However, the time it takes to scan and manually enter data will add time to the project and increase the cost.