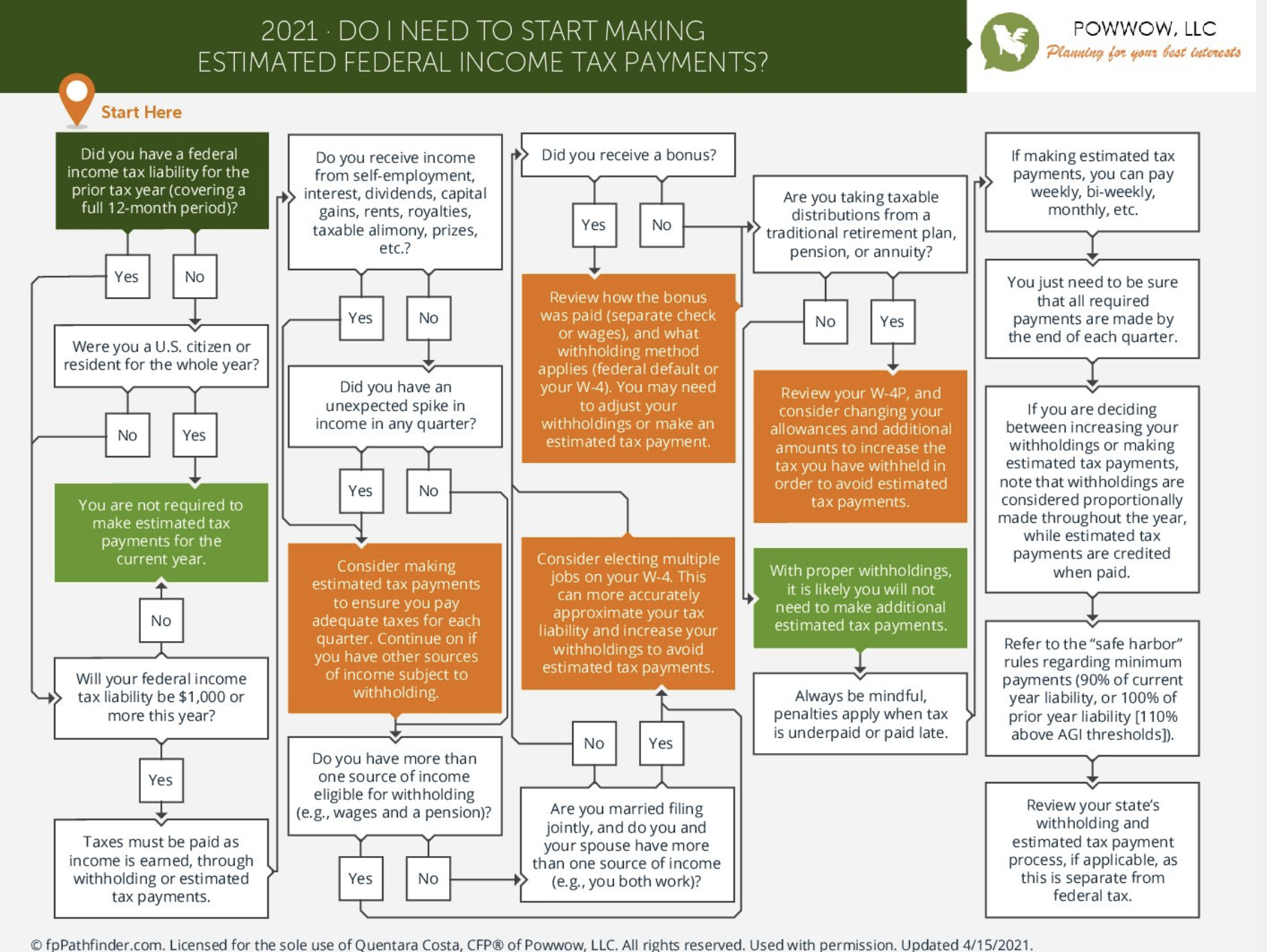

Why Your Paystub Tax Withholdings Are Probably Wrong—and How to Fix Them

Many high-earning professionals have inaccurate paystub tax withholdings, leading to surprises at tax time. Learn why this happens and how Powwow, LLC can help you course-correct midyear.