Should You Use Credit Cards to Pay for Child Care?

Five things to consider before financing daycare NerdWallet recently interviewed POWWOW for an article on an issue plaguing most young families – how to afford

Five things to consider before financing daycare NerdWallet recently interviewed POWWOW for an article on an issue plaguing most young families – how to afford

… Even from hundreds of miles away! Most of us want to have a role in caretaking our aging loved ones, but many of us

“Making the call [on elder fraud] is simple when the thief isn’t related to the client. But when the miscreant is a child or grandchild,

“A recent Merrill Lynch Age Wave survey showed 37% of people over 50 believe they may need long-term care during their lifetime, but the reality

“Opening a certificate of deposit (CD) can be a low-risk way to save for short- and long-term goals, whether it’s a new set of wheels

“Where will your clients live, and for how long? What roles will their children or other caretakers play? Have they considered what they’ll do if

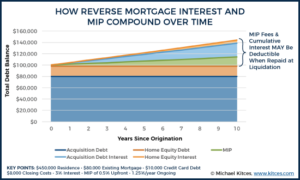

I often receive questions about reverse mortgages, particularly on whether they’re a viable solution to afford elder care. The first thing to realize here is

How do you define success? Nerd Wallet published an article on the importance and strategy behind goal planning. For the most part, this is the

The DOL fiduciary ruling set to launch in April requiring that advisors act in a consumer’s best interest has been tentatively delayed until June 9,

XY Planning Network offers consumer blogs that follow specific interests and subject matter. This is a great (and FREE) way to receive focused information from

Is it worth considering? Age 50-60 has traditionally been the sweet spot for reviewing long-term care insurance options. New research is even indicating that the

Successful planning boils down to two key factors: Working with accurate information Managing behavior It probably comes at no surprise that financial planners mostly struggle

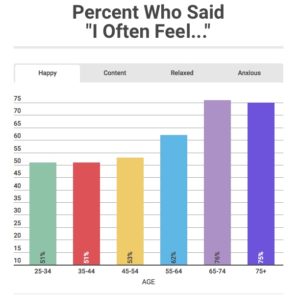

I’m a big believer in discussing elder care with my clients as young as age 50. I use this age as my starting point for

Trying to be more intentional with gifting? US News published a great article on how to be both generous and practical when it comes to

I’m thrilled to share an article highlighting the reasons for my commitment to help seniors and their family. “As a caregiver for her ailing father,

When opportunity knocks, do you answer the door, or complain about the noise? Take some time this week to consider ALL your options, not just

Last night 60 Minutes did a piece on Alzheimer’s research. While scientists believe they have found the cause, preventative treatment is administered too late. Until

90% of people say that talking with their loved ones about end-of-life care is important. 27% have actually done so.* Initiating conversation can make the

Quentara E. Costa of POWWOW, LLC accepted for Membership in the National Association of Personal Financial Advisors (NAPFA) Chicago, IL – Quentara E. Costa

“The only control you have is over the changes you choose to make.” The quote by Nancy Kriseman is a simple reminder to make decisions

In a time where we have access to great sites like Pinterest and Houzz, it’s never been easier to envision our projects, ideas, and events.

“Growing businesses are highly motivated to attract and retain newer team members who are driving the day-to-day business. While these employees may not have accumulated significant wealth, they still

A candle loses nothing by lighting another candle. Over the weekend I came across this quote by James Keller and absolutely loved it. What a

Money – it’s influential, stressful, and tantalizing. I’m always interested in people’s reaction to receiving money because most of the time it’s contrary to what’s

Ahhh, the end of summer. So many clients with stories about their fabulous vacation, and they’re having a hard time accepting it’s over. They come

It’s hard knowing how to allocate your money, especially when you’re feeling stretched in all directions. A big challenge is the balancing act between the

Congratulations!! Now let’s get down to business. There is often so much excitement, joy, and preparation for the baby’s first week home that we can

Elder planning is a touchy but important subject. Whether it’s for yourself or that of a loved one, the impact of poor planning is rarely

Robo or Real? Robo-advisor is a term I come across multiple times a day and there are no shortage of opinion on whether they’re an

A fi-doo-shee-er-ee, or fiduciary in common English, is one of the most important considerations in choosing a financial planner. Don’t believe me? You should, because even entertainment media is

Everything was going fine until… *INSERT EXPENSIVE PROBLEM HERE* happened. A common complaint I hear: Diving deeper into this issue I often find that the real