The History and Business of Valentine’s Day

About half of U.S. adults plan to celebrate Valentine’s Day this year, spending a total of $25.9 billion!

About half of U.S. adults plan to celebrate Valentine’s Day this year, spending a total of $25.9 billion!

It’s time to make sure you’re financially accounted for before the new year rolls around. It may be maxing out HSA and retirement plans, settling debt, or holding realistic assumptions about your spending habits. Here is a full list to consider tackling.

Do Roth IRAs make sense from a tax perspective? The first question may not be whether it’s “right” for you, but whether you’re eligible to even open one at all. That’s where Roth Conversions come into play.

Market downturns, like the one through the first half of 2022, could be a good time to adjust your fund portfolio to minimize the tax bite. Here’s how to calculate the best ways to do that – now and in the future.

Adult children often find themselves unprepared in the position of primary caregiver for their parents. Finances (and even more importantly TIME allocated toward supporting family) can be very dicey for members of the Sandwich Generation.

Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what happens to most such self-promises, so here’s a month-by-month to-do list to cultivate better financial health.

It’s officially Spring, and your closet may not be the only thing that needs a good clean-out. What about your financial habits? Watch my video on how to fix up your finances.

News Years Resolutions – In bite size pieces Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what

If you’re worried about downsizing your home, you really shouldn’t be. While finding the right home for your budget and planning a move can feel

Even if you’re not providing hands-on physical care for an aging parent, you’re still likely spending a ton of time in a project management role.

I recently read Being Mortal by Atul Gawande, MD. His insight perfectly blends medicine and emotion when it comes to the inevitable challenges of aging.

A fellow blogger liked my approach to personal finance by making S.M.A.R.T goals. Read how she implemented this into her life and own blog! https://doingthingsdifferent.net/saving-money-think-s-m-a-r-t/

The deadline for the 2019-2020 FAFSA is midnight, June 30, 2020. The earlier you file, the more grant money you are likely to receive (up to

As a Certified Financial Planner™ specializing in elder care I am asked this question daily. Unfortunately, all too often the family’s immediate reaction is that

It’s important to understand the fine print of your home equity line of credit (HELOC). Make sure not to get swept up in your plans

While success can be defined in a multitude of ways, most boil down to one simple desire – financial freedom. So what happens when a

Whenever I discuss elder care I can count on being asked one question… “What if I run out of money?” Long-term elder care solutions come

“I can’t hear you… LALALALALALALALALALALA” I recently presented on elder care to seemingly dissimilar groups. Despite their backgrounds, they all had the common bond of

“A recent Merrill Lynch Age Wave survey showed 37% of people over 50 believe they may need long-term care during their lifetime, but the reality

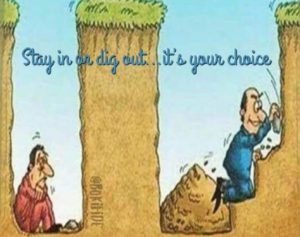

When opportunity knocks, do you answer the door, or complain about the noise? Take some time this week to consider ALL your options, not just

Elder planning is a touchy but important subject. Whether it’s for yourself or that of a loved one, the impact of poor planning is rarely

A fi-doo-shee-er-ee, or fiduciary in common English, is one of the most important considerations in choosing a financial planner. Don’t believe me? You should, because even entertainment media is

Everything was going fine until… *INSERT EXPENSIVE PROBLEM HERE* happened. A common complaint I hear: Diving deeper into this issue I often find that the real

© 2016 – 2025 POWWOW, LLC.

All rights reserved.