The SECURE 2.0 Act – For Retirees (or soon-to-be)

SECURE 2.0 has 90+ new or updated retirement provisions. For retirees, this means expanded catch-up contributions, charitable gifting options, and changes to RMDs.

SECURE 2.0 has 90+ new or updated retirement provisions. For retirees, this means expanded catch-up contributions, charitable gifting options, and changes to RMDs.

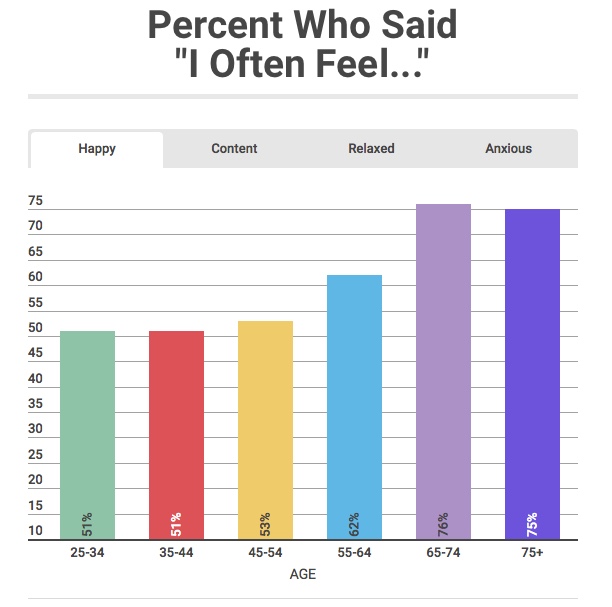

Discover how living a satisfying retirement is worth more than secured finances.

One of the most common questions for anyone planning for retirement is: “What’s the best age to start Social Security?” Read how the program works, how it’s changed, and what to consider.

Have you seen a Roth option available in your 401(k)? Read on to help determine if it’s the right option for you.

Social Security benefits for millions of Americans will increase 5.9% in 2022. Taxable wage maximum for SS tax increases to $147k.

SECURE Act 2.0 focuses on incentivizing people to save more for retirement. But will it be passed?

We can get tunnel vision when it comes to following “Rules of Thumb.” I dare you to push back when it comes to maxing out 529 Plans and 401(k)s.

If you are in a cash crunch, you might consider taking out a 401(k) loan. But before you do, you should know the rules and

While success can be defined in a multitude of ways, most boil down to one simple desire – financial freedom. So what happens when a

Fantasizing that the money will somehow appear isn’t helpful. Here’s what is.

The idea of retirement conjures different lifestyle images and meanings for any given person. While some are counting down the minutes to completing their final

Powwow, LLC was interviewed by CBS MoneyWatch to discuss how home equity can be utilized for retirement. In my years of planning I’ve typically seen

Successful planning boils down to two key factors: Working with accurate information Managing behavior It probably comes at no surprise that financial planners mostly struggle