A 2025 Market Recap: How Smart Portfolios Quietly Did Their Job

This year reminded us why investing isn’t about chasing headlines, it’s about building a plan that works across all kinds of markets. Here’s what really

This year reminded us why investing isn’t about chasing headlines, it’s about building a plan that works across all kinds of markets. Here’s what really

If you’ve received a notice from Fidelity or Vanguard inviting you to participate in their securities lending program, you might be wondering if it’s a

Target date funds are a powerful tool for retirement savers—but they’re not a one-size-fits-all solution. Learn when they work best, when to reconsider, and how to choose the right one for your goals.

Mutual funds often issue large year-end capital gain distributions and dividends, impacting your tax bill. Learn why this happens, how to anticipate it, and what to do.

Learn how to safeguard your finances from potential scams and Ponzi schemes by identifying red flags and discovering essential insights to protect yourself and your investments from financial fraud. Learn who and what’s involved with investment management to help ensure a secure financial future.

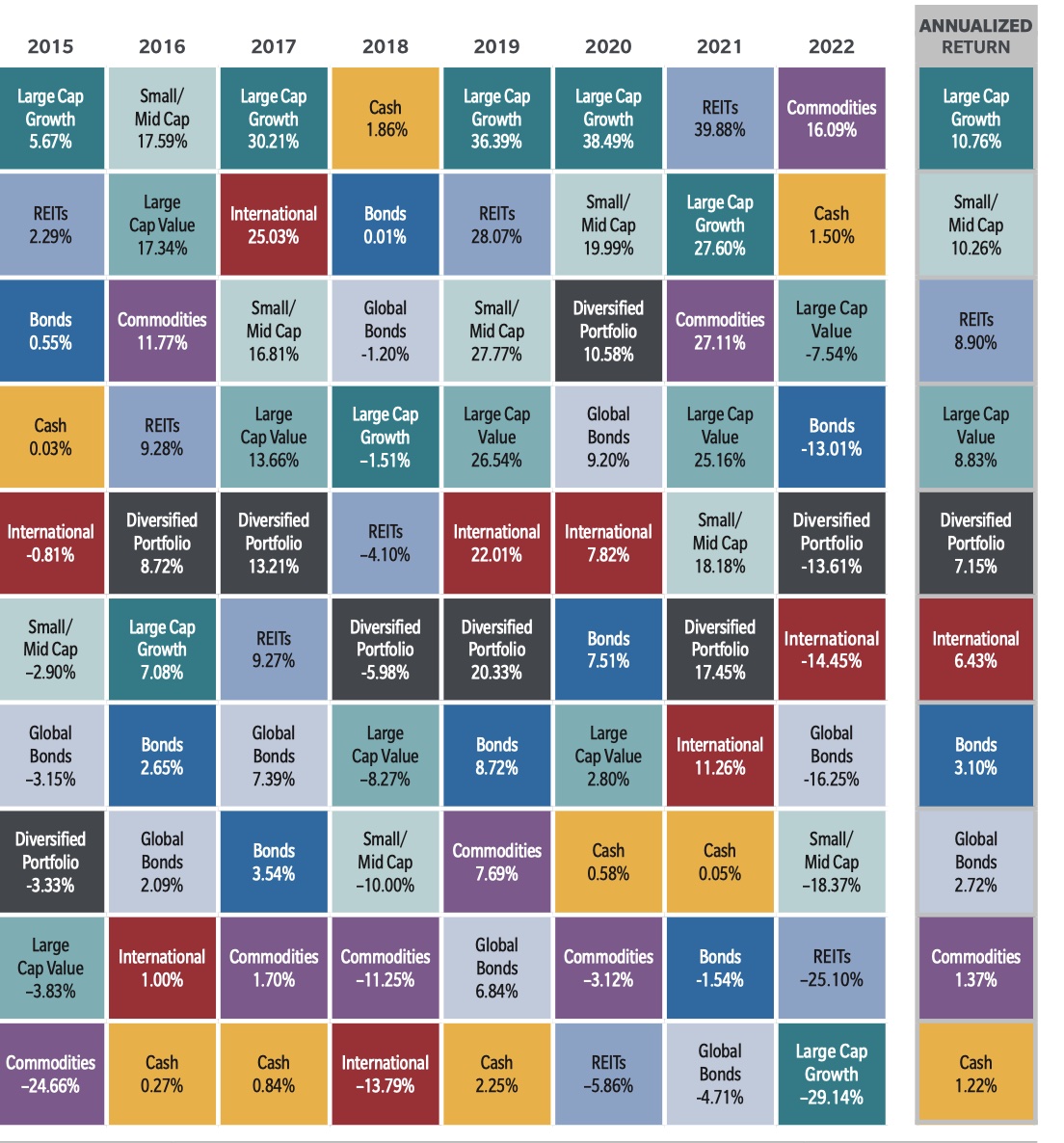

There is no need to hunker down in just the SP500 or gold to see returns, diversification is preached for a reason. This chart shows annual returns for eight broad-based asset classes. Notice how the “leadership” changes from year to year, and how competitively the diversified portfolio performed over 20 years (see the “annualized return” column).

Many studies confirm “The January Effect” exists, so will the monthly performance for January predict how 2023 will pan out?

Do Roth IRAs make sense from a tax perspective? The first question may not be whether it’s “right” for you, but whether you’re eligible to even open one at all. That’s where Roth Conversions come into play.

Raising rates may be throwing the market into turmoil… but it’s finally an opportunity to make some money on cash!

Ask yourself three questions before you use actual dollars to buy cryptos In very simple terms, there are three main asset classes: equities (stocks), fixed-income

There is so much chatter about inflation impacting the stock market – not to mention gas, lumber and chlorine skyrocketing in price, what’s the deal? Here’s a primer.

Health Savings Accounts are a tax-trifecta savings vehicle that are often overlooked due to bias against the less popular Flex Savings Accounts.

We can get tunnel vision when it comes to following “Rules of Thumb.” I dare you to push back when it comes to maxing out 529 Plans and 401(k)s.

The 2020 performance for the major U.S. indices was nothing short of impressive, especially given the headwinds of COVID-19 and the drama surrounding the presidential election.

Everyone is asking – how will my goals be impacted by the upcoming election? When it comes to the stock market, elections matter less than

Your checking account is at an all time high and you’re eager to do something more with your money. Anything has to be better than

What’s happening? The last couple weeks have certainly been rough on everyone. Stock markets across the world have been on a downward spiral with bouts

CD interest rates can be higher than a typical checking or savings account and are affected by these factors.

Feeling insecure in your ability to banter on about politics, taxes, and headline news the next time you sit down with family and friends? I

“Opening a certificate of deposit (CD) can be a low-risk way to save for short- and long-term goals, whether it’s a new set of wheels

The DOL fiduciary ruling set to launch in April requiring that advisors act in a consumer’s best interest has been tentatively delayed until June 9,

Robo or Real? Robo-advisor is a term I come across multiple times a day and there are no shortage of opinion on whether they’re an

A fi-doo-shee-er-ee, or fiduciary in common English, is one of the most important considerations in choosing a financial planner. Don’t believe me? You should, because even entertainment media is