Raising Financially Capable Kids Without Turning Childhood Into a Transaction

Learn how to teach kids money values without allowances, guilt, or pressure — and how parents can model healthy financial decision-making at home.

Learn how to teach kids money values without allowances, guilt, or pressure — and how parents can model healthy financial decision-making at home.

Get ready for Halloween without breaking the bank! In this blog, I share practical tips and tricks for saving on costumes, décor, candy, and party planning. Perfect for busy families looking to enjoy the spooky season while keeping finances in check!

Behind the Curtain: How Colleges Review Applicants When families think about college admissions, it’s easy to picture an admissions officer sitting in an office, carefully

Teach your middle schooler key money concepts related to taxes, interest, and investing. This guide covers introducing financial literacy skills to kids ages 10–14 in an age-appropriate and engaging way.

Choosing guardianship for your children is one of the most important decisions in estate planning. By selecting the right person, providing financial resources, communicating your parenting philosophy, and ensuring easy access to estate plans, you can create a stable and supportive future for your children. If you haven’t yet named a guardian or need to update your estate plan, now is the time to take action.

When moving to a new area, finding the right public school for your children often tops the list of priorities. A high-quality education can set

Discover the best ways to manage your child’s cash gifts, from piggy banks to trusts, and learn how to maximize growth while teaching financial responsibility.

Hiring a nanny over using daycare can offer personalized care and certain conveniences, but it also comes with significant financial and employer responsibilities. From payroll taxes and liability insurance to agency fees and contract considerations, the costs and time associated with correctly managing it all can add up quickly. By understanding these financial implications and planning accordingly, you can make an informed decision that aligns with your family’s needs and budget.

The 2025-2026 federal student aid application will open to all students as late as Dec. 1, mirroring delays last year.

Supporting your children financially goes beyond funding their college expenses. It’s about empowering them with the knowledge, skills, and resources they need to thrive in all aspects of life.

The FAFSA Simplication Act will have families seeing changes to their application process and aid package this year. Many will do well by the calculation adjustments. And at the very least, they should find the application process much easier. Others may walk away with less than expected.

Life insurance can provide a valuable safety net for loved ones who depend on you financially. But children usually don’t have jobs, so no one depends on their income. Forbes look at the possible reasons for buying life insurance for children.

Teaching young children smart money habits is a valuable life skill that can set them on a path to financial responsibility and success. Here are some tips on how to teach financial literacy to children aged 6-9.

Teaching young children smart money habits is a valuable life skill that can set them on a path to financial responsibility and success. Here are some tips on how to teach children aged 3-5 smart money habits.

They’re restarting come October 2023 – don’t delay understanding your options for payment, payment method, and ensure it’s folded into your budget.

Student loan proposals didn’t go in Biden’s favor during debt ceiling negotiations and a deciding vote by the Supreme Court. The Biden Administration hopes to now find a win revamping the income-driven repayment plan.

Your child’s IEP and support network will not follow them to college, so it’s critically important for them to become their own advocate as they navigate the world of college accommodations.

I’ve had a slew of clients adding “wedding” to their list of goals. Is their 20-something child even engaged yet – not necessarily, they just want to be prepared when the special day comes. But a part from funding the day, there is plenty else to consider as two become one.

The attraction of 529 college savings programs is that they provide for investment earnings to grow on a tax-deferred basis, making them a tax-savvy choice compared to other options.

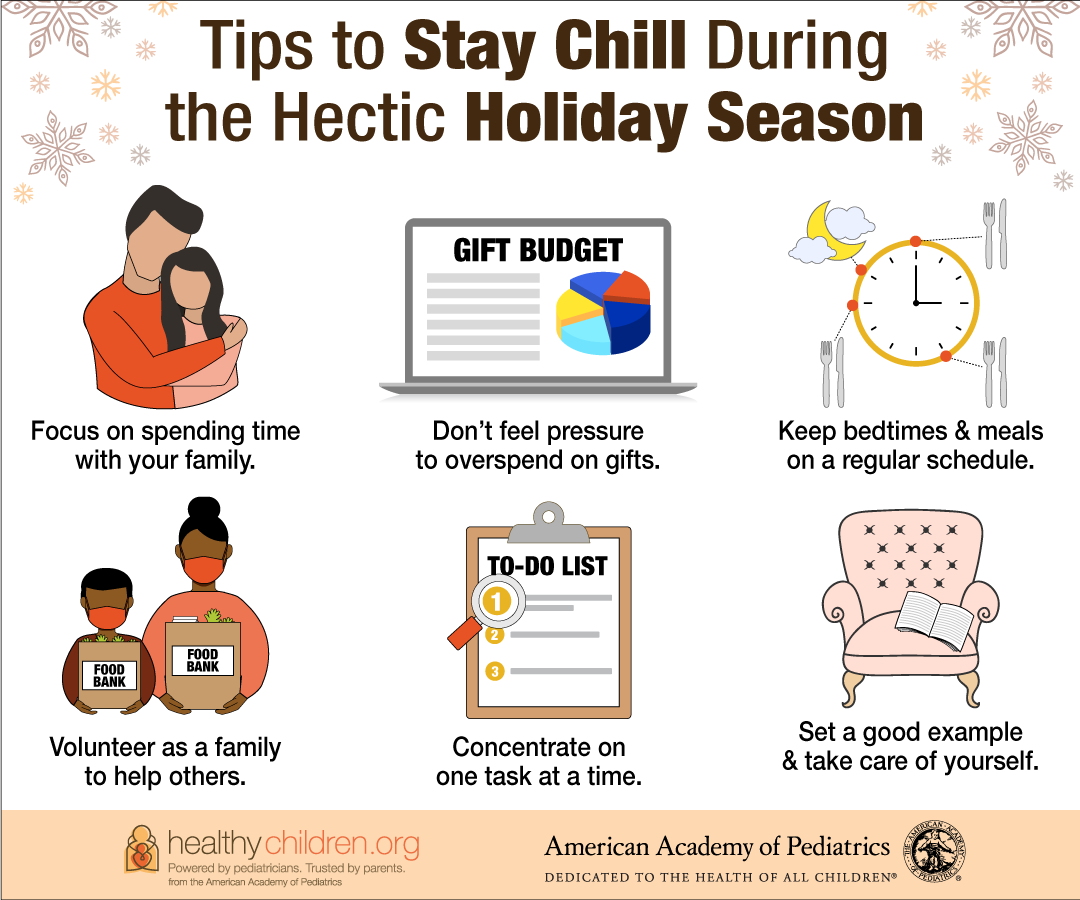

What’s the best way to discuss financial limits as a family without stressing out children? How can parents support children’s well-being while taking care of their own?

Calculate a school’s return on investment to determine whether it is a good investment or not.

Feelings have run amok after Biden outlines his executive action for student loan forgiveness. Read about the program and my own thoughts.

From one of our favorite local attorneys, Adam Minsky discusses the likelihood of Biden offering additional forgiveness and deferment on student loans, despite Republicans submitting a bill to resume payments.

Direct PLUS loans have become very popular in college planning. This post by Student Aid should answer all your major questions. It also goes into good detail on how to start repaying them after graduation vs at disbursement.

Although the college application process begins in earnest during your senior year, there are things you can be doing along the way to ensure you’re ready to put your best foot forward.

Is there an end game to the student loan repayment extensions? (Redirect to Nerd Wallet)

Lately, I’ve had a number of clients and prospects ask how to pay for college. Not in the future – but RIGHT NOW. They’re past

With the CARES Act expiring in January 2022, many will be asked to resume student loan payments – but can they afford to pay?

Keep the kids busy this Thanksgiving! Enjoy this coloring page that can decorate your table.

While the checklists grow and the kids soak in the last few minutes of summer break, it’s important to remember college planning and back-to-school shopping.

Your office may be reopening and you’re in a position to secure and afford child care. The Balance does a great job explaining care options.

Federal student loan payments and collections are set to resume in October 2021. There is a chance that the pause may be extended or a ramp-up plan will be put in place.

Acceptance letters are rolling in and it’s time to make a decision on college. If your top pick is more expensive than the rest… ask for more aid. Here’s how from Student Loan Hero…

There is a ton to consider as you decide on the right college. Make sure you’ve considered all your options and resources.

Embark on a brighter future with our comprehensive guide on getting financial aid for private schools.

The holidays are here as we struggle to find a balance between safe and sane during COVID-19, all while our children are watching. Here is some great tips from pediatricians on how to keep calm and carry-on.

The holidays are here as we struggle to find balance between safe and sane during COVID-19. Your children are likely looking forward to the normalcy of holiday tradition,

Halloween is my favorite time of year because it offers certain qualities other holidays lack: It’s an opportunity to be creative and try a new

One extracurricular activity that every student can master while in college is personal money management. Typically, a student’s daily spending is done on an improvised

The coronavirus is bringing waves of changes to how we approach everyday tasks and traditions. The same will be true for college admissions. While colleges

Student loan debt presents a serious financial burden for countless graduates. Even the XY Generation (you?) is struggling to earn enough money to take care

The SECURE Act was signed into law on December 20, 2019. Many changes were made that will materially impact retirees, 401(k) plans, and families. So

The deadline for the 2019-2020 FAFSA is midnight, June 30, 2020. The earlier you file, the more grant money you are likely to receive (up to

Did you feel attacked at your last family get-together from the mere mention of your intent to pay or not pay for your child’s first

Today, roughly one in five women in the United States do not have children. For the first time in U.S. history there may soon be

Make sure your child is aware of the process to receive support for their learning disability in college I recently met Marylee Palmer of By

“85% of parents expect their child to graduate with debt, estimating an average of $45,000 in student loans” according to a Fidelity survey. In one

Is it just me, or does making a bed instantly provide a feeling of accomplishment? For me, it doesn’t have to be perfect (far from

Five things to consider before financing daycare NerdWallet recently interviewed POWWOW for an article on an issue plaguing most young families – how to afford

Trying to be more intentional with gifting? US News published a great article on how to be both generous and practical when it comes to

Congratulations!! Now let’s get down to business. There is often so much excitement, joy, and preparation for the baby’s first week home that we can