A 2025 Market Recap: How Smart Portfolios Quietly Did Their Job

This year reminded us why investing isn’t about chasing headlines, it’s about building a plan that works across all kinds of markets. Here’s what really

This year reminded us why investing isn’t about chasing headlines, it’s about building a plan that works across all kinds of markets. Here’s what really

Many of the people we work with don’t consider themselves “behind” financially. They earn strong incomes.They save consistently.They manage their own investments. And yet, there’s

If you’ve received a notice from Fidelity or Vanguard inviting you to participate in their securities lending program, you might be wondering if it’s a

Target date funds are a powerful tool for retirement savers—but they’re not a one-size-fits-all solution. Learn when they work best, when to reconsider, and how to choose the right one for your goals.

Learn how to safeguard your finances from potential scams and Ponzi schemes by identifying red flags and discovering essential insights to protect yourself and your investments from financial fraud. Learn who and what’s involved with investment management to help ensure a secure financial future.

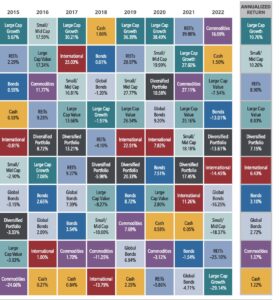

There is no need to hunker down in just the SP500 or gold to see returns, diversification is preached for a reason. This chart shows annual returns for eight broad-based asset classes. Notice how the “leadership” changes from year to year, and how competitively the diversified portfolio performed over 20 years (see the “annualized return” column).

Many studies confirm “The January Effect” exists, so will the monthly performance for January predict how 2023 will pan out?

Do Roth IRAs make sense from a tax perspective? The first question may not be whether it’s “right” for you, but whether you’re eligible to even open one at all. That’s where Roth Conversions come into play.

Market downturns, like the one through the first half of 2022, could be a good time to adjust your fund portfolio to minimize the tax bite. Here’s how to calculate the best ways to do that – now and in the future.

Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what happens to most such self-promises, so here’s a month-by-month to-do list to cultivate better financial health.

Ask yourself three questions before you use actual dollars to buy cryptos In very simple terms, there are three main asset classes: equities (stocks), fixed-income

Health Savings Accounts are a tax-trifecta savings vehicle that are often overlooked due to bias against the less popular Flex Savings Accounts.

The 2020 performance for the major U.S. indices was nothing short of impressive, especially given the headwinds of COVID-19 and the drama surrounding the presidential election.

News Years Resolutions – In bite size pieces Cleaning up personal finances remains one of the top resolutions every New Year. But we all know what

Your checking account is at an all time high and you’re eager to do something more with your money. Anything has to be better than

What’s happening? The last couple weeks have certainly been rough on everyone. Stock markets across the world have been on a downward spiral with bouts

Fantasizing that the money will somehow appear isn’t helpful. Here’s what is.

Maybe you have an idea of when you’d like to buy your first home or retire from the workforce. But just how realistic are your

CD interest rates can be higher than a typical checking or savings account and are affected by these factors.

“The person you named 10 years ago to be your power of attorney isn’t necessarily the correct fit for today and could be the wrong

“Opening a certificate of deposit (CD) can be a low-risk way to save for short- and long-term goals, whether it’s a new set of wheels

Trying to be more intentional with gifting? US News published a great article on how to be both generous and practical when it comes to

Robo or Real? Robo-advisor is a term I come across multiple times a day and there are no shortage of opinion on whether they’re an