As the CARES Act expires in January, expect an outcry about Student Loan Payments

You might remember that back in March of 2020, Congress passed the CARES Act that paused payments and set interest payments to 0%. But with the end of the CARES Act on January 31st of 2022, those monthly payments were set to resume. Just before Christmas 2021, President Biden stepped in to prolong the pause by 3 months. The new date for repayments will begin May 1, 2022.

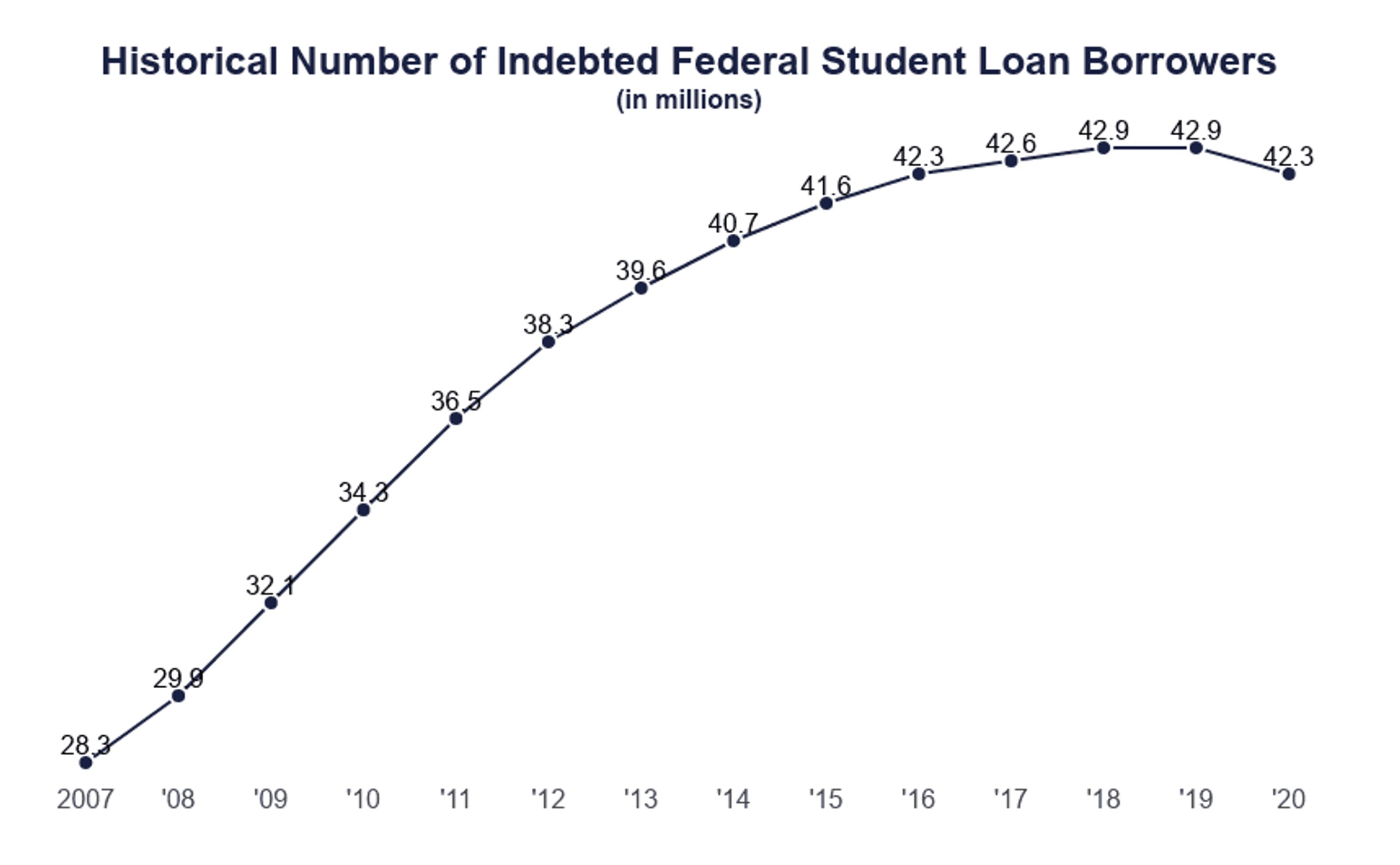

Did you know that there are over 44 million Americans that have student loans, and most of them (42.3 million) carry a balance on a federal loan totaling trillions of dollars?

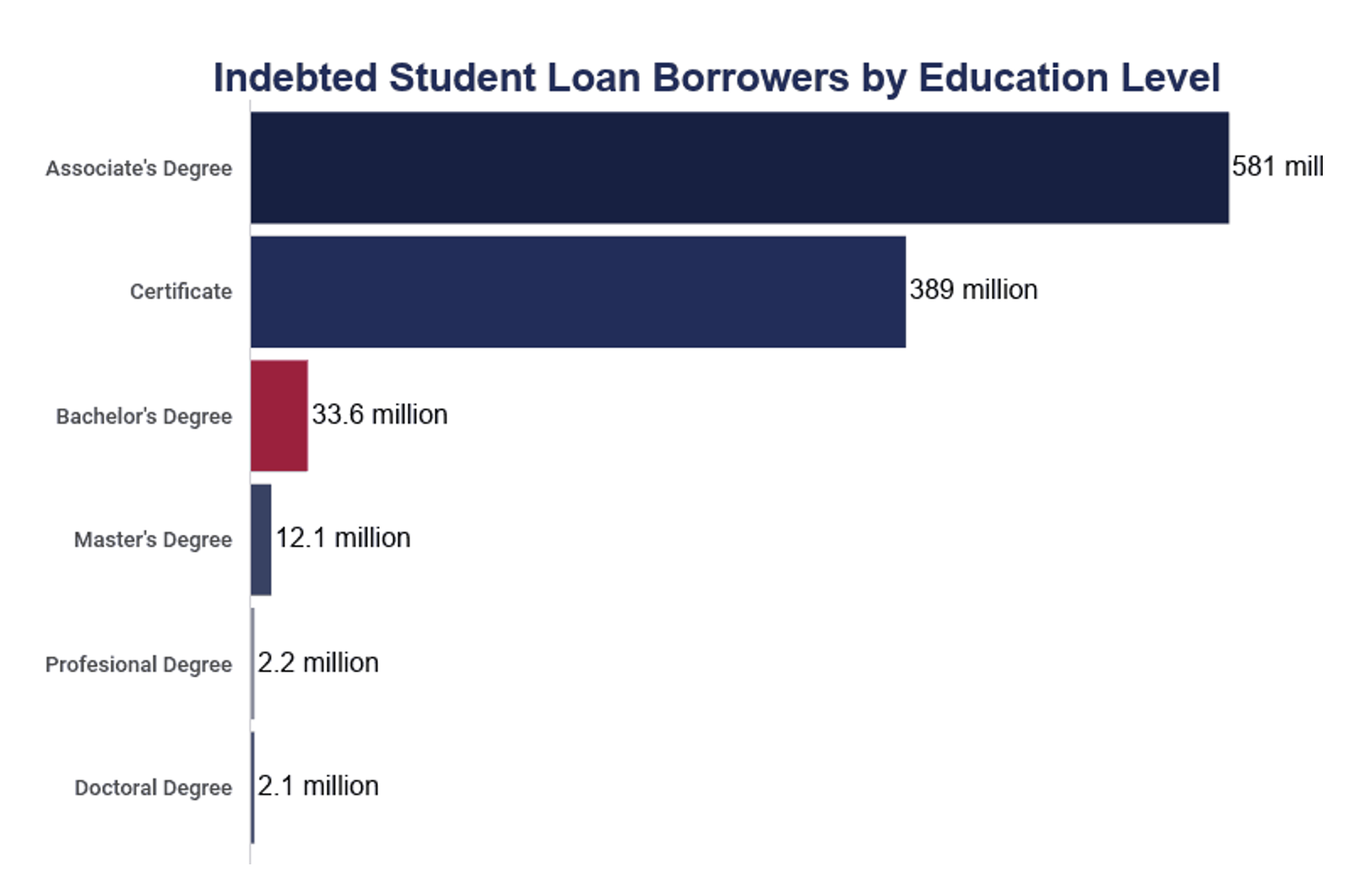

That could cause significant hardship for millions of Americans and thousands of employers – but especially for recent graduates and those in lower-paying jobs. I was personally shocked to see that the vast majority of debt stems from those with associate degrees and certificates, which in theory should be the least expensive form of education. However, while these programs help to put you on a career path, they’re not necessarily high-paying ones, which makes paying any size loan back problematic.

The Student Loan Pandemic

Let's look at the facts...

So, Who Should Pay?

As the CARES Act comes to a close, many are looking to their employers for helping in paying off their student debt. In fact, according TIAA, 60% of those surveyed felt their employer should be responsible for helping them with student loan debt.

“Our survey tells us that almost 95% of not-for-profit and public sector employees will experience at least some difficulty keeping up with the continuation of student loan payments,” says TIAA. “People are feeling frustrated — they’re feeling fearful, hopeless, angry and even ashamed of this burden they carry.”

The survey also stated that 85% of respondents reported student loan debt as a source of stress and close to half have had to make a major life change in order to continue payment – think not buying a home, not getting married, etc.

Is anything being done?

There is always talk of actions being taken for widespread debt forgiveness. Last year (2021), the Education Department canceled $11.5 billion worth of student loan debt for 580,000 borrowers.

In summary, there are 4 qualifiers:

- Total and permanent disability discharge

- Closed school discharge

- Borrower defense to repayment

- Public Service Loan Forgiveness

Despite the Public Service Loan Forgiveness qualifier having the least amount of people impacted – it yields the most relevance at Powwow. Potentially it’s because the other qualifiers are relatively straight forward, whereas the public service forgiveness program has been notoriously confusing. But adjustments were recently made so public servants like nurses and teachers can count previously non-eligible work history toward their 10-yrs in public service requirement. Powwow has already had a few clients positively impacted. Some are immediately eligible and others just need to submit proof of their work history to have it added to their public service record.

How does this impact the US at large?

I wrote this piece because even if you’re not burdened with student loans, you’re still indirectly impacted. Money paid toward student loans means less entering the economy. As the surveys imply, people are holding back from participating in major life milestones due to their inability to afford it, which has a ripple affect on us all. And those with loans that ultimately default are severely limited in participating in the economy. As you would expect, actions are taken to garnish wages, reduce credit scores, revoke professional certifications, etc.

Adapted with permission from FMeX.