Because of the generous capital gains exclusion on selling a primary residence, you may find that you do not owe Federal taxes when it comes time to sell your home. But there are situations in which a seller may incur a tax liability, especially if the sale price is very high, if the house is sold soon after purchase, or if the owners are unmarried or are selling as the result of a divorce. In many of these cases, however, the amount owed to the IRS can be minimized, or offset, with some advance planning.

Generally, if you owned and lived in the house you are selling for two of the five years prior to the sale, then you are permitted to exclude from your taxable income up to $250,000 of the capital gain if you are a single filer, or $500,000 of the gain if you are married filing jointly.

So, even if you rented your home for a period of time before selling it, the house still qualifies as your primary residence if you lived in it for at least two out of the five years preceding the sale. To qualify for the $500,000 exclusion for married couples, at least one spouse must meet the ownership requirement, and the couple must have lived in the house for two of the five years prior to the sale. You are not, however, entitled to take a deduction for a loss on the sale of your primary residence, nor are you permitted to claim an exclusion on the sale of a primary residence more than once every two years.

Even if you do not meet these requirements, you may still be able to claim a full or partial exclusion under certain circumstances. If, for example, you were awarded ownership of the home as part of a divorce or separation settlement, you are allowed to count the time the house was owned by your former spouse as time you owned the home in order to pass the ownership-and-use test.

Similarly, if one spouse should die and the surviving spouse has not remarried prior to the date the home is sold, the surviving spouse can count the period the deceased

Similarly, if one spouse should die and the surviving spouse has not remarried prior to the date the home is sold, the surviving spouse can count the period the deceased

spouse owned and used the property toward the ownership-and-use test. You’ll also have two years from the date of death to qualify for the higher $500,000 gains exclusion. If the sale occurs after that time you’ll be considered single. Also keep in mind that at death there should be a partial step up in basis on the home value. For instance, let’s say you purchased the home together for $50,000, you’d each be starting with a basis of $25,000. At the first death the home is valued at $500,000. Your spouse’s basis steps up to $250,000 and your own basis remains $25,000, meaning the new basis is $275,000. The gain on the sale would now only be $225,000 rather than $450,000. This means there is no reason to feel rushed about the selling the home within the two year period simply to benefit from the doubled exemption. In addition, any capital improvements over the years can be factored in to boost basis, just make sure to have documentation to support your figures.

Special rules also apply for members of the uniformed services, foreign services, and intelligence agencies who are selling a house they did not live in for the required two years because they were on “qualified official extended duty” at a duty station at least 50 miles from their primary residence.

Watch my video to learn more about taxes owed on a home sale and other things to consider!

Finally, you may qualify for a reduced exclusion even if you do not pass all of the tests due to a change of employment, a change in health status, or other unforeseen circumstances, such as a divorce or the birth of twins or triplets. If, for example, you were a single person who lived in the home for one year before selling it, but had to move to take a job in another city, you would be entitled to claim a $125,000 exclusion on the profit of the sale.

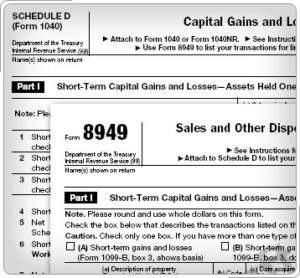

If you sell your home at a profit that exceeds the $250,000 or $500,000 exclusion limits, you are generally required to report the excess profit as a capital gain on the 1040 Schedule D form. However, in assessing the size of your gain, you are permitted to deduct not only the tax basis of your property—which encompasses the original purchase price, plus the cost of capital improvements, minus depreciation—but also closing costs, selling costs, and the costs of decorating and repairs made within 90 days of the sale that were made to increase the home’s attractiveness to prospective buyers.

If you sell your home at a profit that exceeds the $250,000 or $500,000 exclusion limits, you are generally required to report the excess profit as a capital gain on the 1040 Schedule D form. However, in assessing the size of your gain, you are permitted to deduct not only the tax basis of your property—which encompasses the original purchase price, plus the cost of capital improvements, minus depreciation—but also closing costs, selling costs, and the costs of decorating and repairs made within 90 days of the sale that were made to increase the home’s attractiveness to prospective buyers.

If you are preparing to sell or have recently sold your home, contact Quentara to find out how this transfer of wealth affects your financial plan.