Housing prices have increased every single month for the past 12-years

The housing market has been frustrating for buyers and a boon for sellers, but there are signs that those frustrations might be easing – depending on where you live.

Would-be buyers have struggled with historically low inventories, crazy bidding wars and now have to add rising mortgage rates to their worry list. Sellers on the other hand have been rejoicing as average housing prices continue to increase month-over-month and year-over-year, with average home prices jumping 15% in the last 12 months.

But sellers also face a dilemma: where do they go if they do in fact sell? And while there are signs that 2022 might see some cooling off, there are also signs that the relief will be too little – and maybe not at all in certain markets.

Location, Location, Location

It’s always been about location. Some areas simply appreciate faster and more rapidly than others. Cities are usually at the top of the list for faster appreciation, but also suburban areas being gentrified. My hometown of Kingston, NY has been taken over by remote city workers from Manhattan and Brooklyn and investor’s who were looking to take advantage of Trump’s Opportunity Zone program. The entire Hudson Valley and into the Catskills has seen a revitalization. The result is that homes have been scarce to find, and when they become available, prices for locals seem relatively outrageous. And when home prices go up, most other things do as well. I paid nearly $40 for a basic chicken parm dish the last time I visited and I’m still scandalized by it.

How the nation shapes up:

- Existing-home sales in the Northeast slid 2.9% in March, recording an annual rate of 670,000, an 11.8% fall from March 2021. The median price in the Northeast was $390,200, up 6.8% from one year ago.

- Existing-home sales in the Midwest declined 4.5% from the prior month to an annual rate of 1,270,000 in March, a 3.1% drop from March 2021. The median price in the Midwest was $271,000, a 10.4% jump from March 2021.

- Existing-home sales in the South dipped 3.0% in March from the prior month, registering an annual rate of 2,620,000, a decrease of 3.0% from one year ago. The median price in the South was $339,000, a 21.2% surge from one year prior. For the seventh straight month, the South experienced the highest pace of price appreciation in comparison to the other three regions.

- Existing-home sales in the West held steady compared to the previous month, posting an annual rate of 1,210,000 in March, down 4.7% from one year ago. The median price in the West was $519,900, up 5.4% from March 2021.

The National Association expects that housing transactions will contract by 10% this year, home prices will readjust in 2022 and gains will be about 5%.

Rising Mortgage Rates

A rise in mortgage rates does impact borrowing costs and borrowing abilities and housing will absolutely feel the effect. By how much is anyone’s guess and more a function of location and supply.

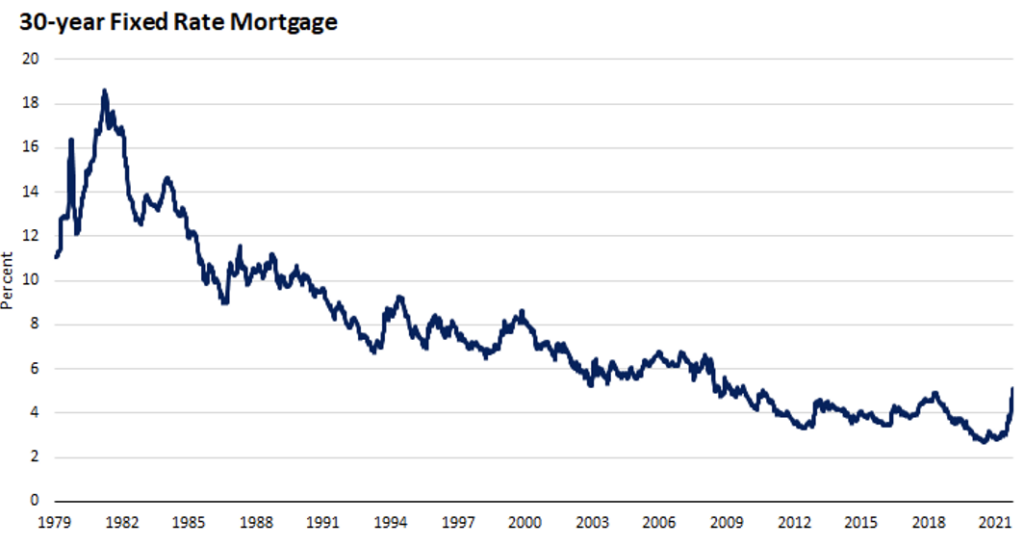

On top of everyone’s mind is the fact that the average 30-year fixed-rate mortgage moved above 5% from 3% six months ago. But it’s worth noting that mortgage rates hit 5% in 2011 and 2018 – and averaged over 7% from 1990 to 2010.

However, would-be-buyers tend to remember recent history and mortgage rates have been very low for a long time. In fact, mortgage rates have averaged 3.7% from 2016-2021 and 3.0% over the last two years.

But think about this: The median existing-home price for all housing types in March was $375,300, up 15.0% from March 2021 ($326,300). This marks 121 consecutive months of year-over-year increases, the longest-running streak on record. That’s more than 12-years.

Housing Market

Intuitively, a rise in borrowing costs will take some of the frenzy out of housing market sales. And to underscore this point – although one month does not make a trend – we saw that the existing home sales were off 2.7% in March and mortgage applications are way down. I would argue that many of these applications were related to refinancing existing homes, not for the purchase of new ones. So brokers will see less work given refinancing to lock in low rates no longer makes sense.

Here are a few more stats from the National Association of Realtors:

- Existing-home sales fell for the second straight month in March to a seasonally adjusted annual rate of 5.77 million.

- Sales were down 2.7% from the prior month and 4.5% from a year ago.

- The inventory of unsold existing homes increased to 950,000 as of the end of March. That would support 2.0 months at the monthly sales pace.

- The median existing-home sales price rose to $375,300, up 15% from one year ago.

The good news for everyone? Well, housing costs represent a big part of inflation, and if home-price appreciation slows down even a little bit, so will inflation.

What should you be considering right now?

According to Black Knight, Inc. the US housing market was considered the least affordable in July 2006. Unfortunately, we’re almost again at that level. At that time, it took about 34.1% of someone’s median income to pay just the principal and interest on a mortgage (assuming a 20% downpayment). As of April 2022, we’re at about 32.5%. To meet or exceed the worst ever record, another 0.5% rate increase or another 5.0% rise in home prices would put us over the edge. So unfortunately, it sounds like every day that passes this summer becomes a worse time to buy.

With that black cloud overhead, I asked my friend, Matthew Teeter of GoldCoast Mortgage, what should a buyer be considering right now?

“Of course, the most important factor you need to consider when buying a home is the needs of you and your family. It’s beneficial to look for great buying opportunities, but the price is just one aspect of the home buying experience you need to weigh against other needs, like location, nearby schools, amenities, and more.”

And I tend to agree. But no, I don’t want anyone using 40%+ of their income to pay for housing. I don’t even think a bank will allow you do to that (anymore)- thankfully! But knowing the affordability of even using 20-30% of your income on housing is important to understand to make you feel confident in the decision. Especially because your choice for housing almost always influences your bigger picture. Running a financial plan can certainly help provide context related to the affordability of a home and all the financial changes that come along with it (education options, home insurance/tax, pay range, etc).