What’s happening?

The last couple weeks have certainly been rough on everyone. Stock markets across the world have been on a downward spiral with bouts of rallying that don’t seem to last long. The headlines regarding the Coronavirus were the primary culprit.

While equity markets struggle, traditional safe havens like US treasuries saw yields fall and prices rise. Yields on the 10-year treasuries are nearing all-time lows.

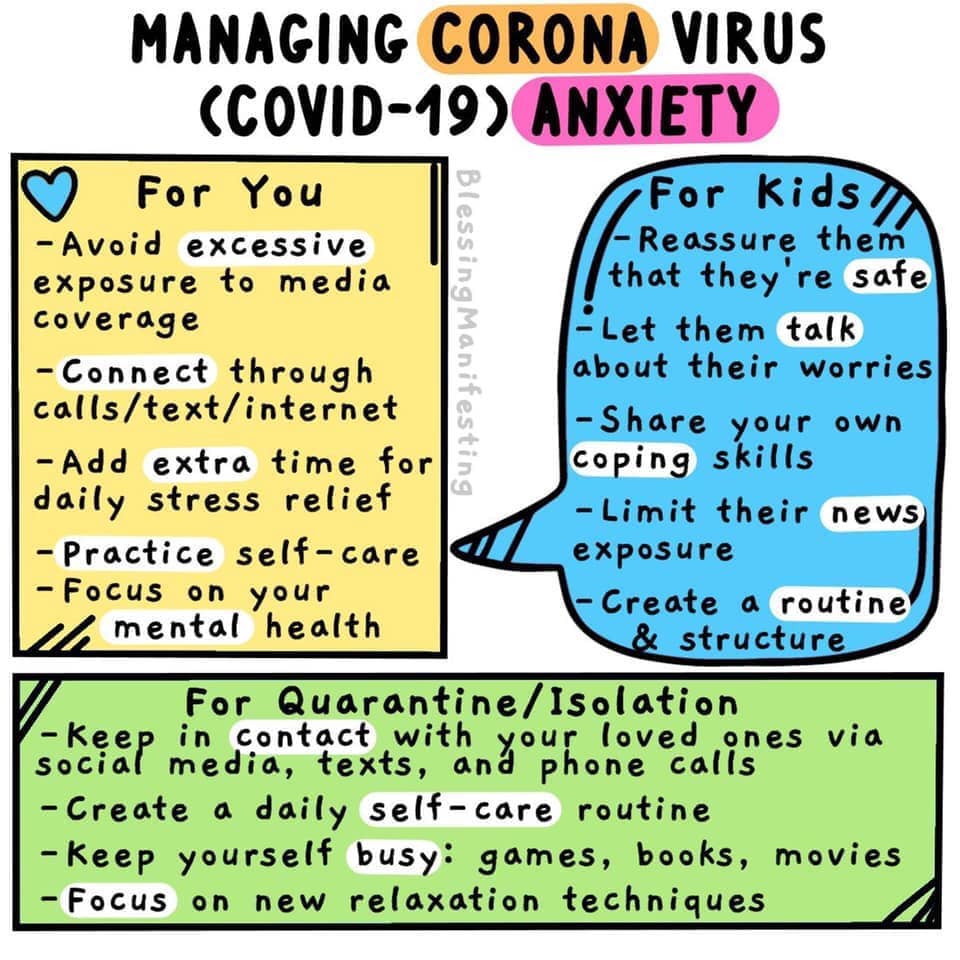

These headlines can be pretty scary and the news media has no hesitancy to play on those emotions, adding illustrations of panicked traders and images of red monitors and negative numbers everywhere. At times like this understand that the agenda of the media is very different than yours. They are paid to get readers and attention, not to help investors reach their long-term goals.

There are many questions that arise when an unforeseen risk like the Coronavirus presents itself. Should I be reducing my stock exposure? Should I get out of all China holdings? Should I be buying something “safe”? Ultimately, those are questions for traders, not long-term investors. As Warren Buffett was quoted, “The real question is: Has the 10-year or 20-year outlook for American businesses changed in the last 24 or 48 hours?” Now consider expanding on that to include businesses globally. You’d likely be hard pressed to see a case that long-term fundamentals have changed.

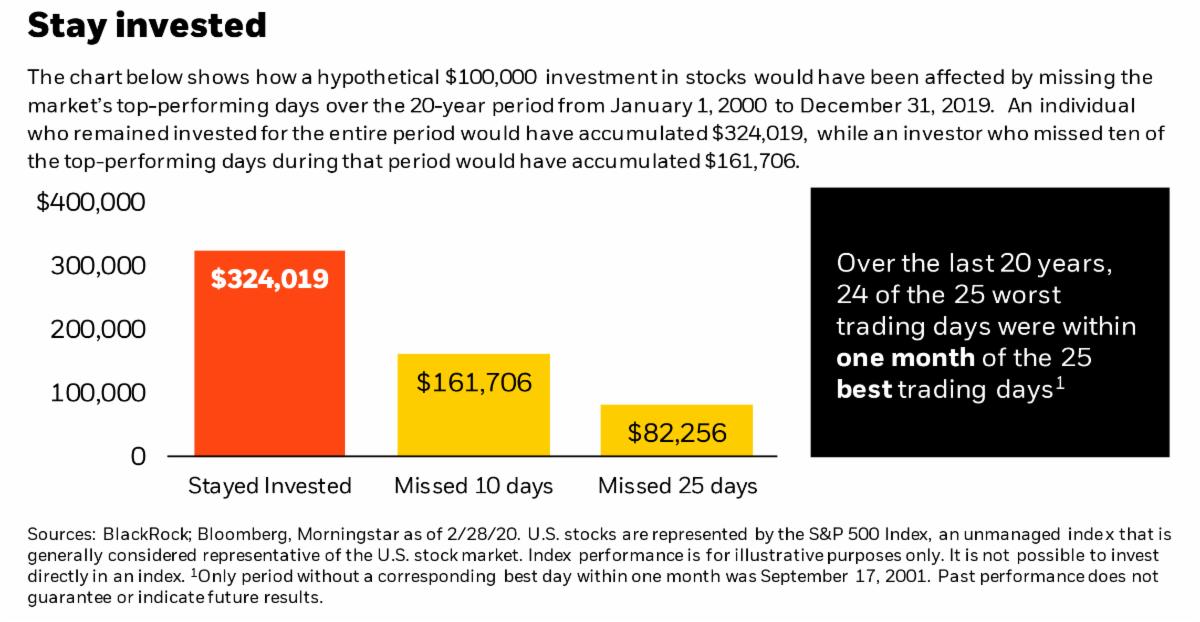

Yes, the Coronavirus may have an impact on the global economy. Yes, stocks may continue to see heightened volatility from here and may sell off even further. Yes, these are challenging times. But without risk and volatility, there would not be an expected return premium for holding stocks. No, most advisors don’t think it is possible to know enough about what the future holds to be able to profit from it. In order to profit from news like this, one has to know something that other market participants do not. All advisors really know is the market is lower than it was before and based on historical data we can expect the market to eventually recover.

Adapted from First Ascent Asset Management

What should you be doing now?

- Take heart knowing that your automatic savings contributions into retirement accounts, etc, are all buying in low, which follows the mantra of “buy low, sell high.”

- If you’re sitting on cash, now may be the time to get it invested since the market has come down. Have you funded your IRAs, Roths, HSAs, and 529s this year? You even have a bit of time left to fund retirement accounts for 2019 if you haven’t done so already (April 15 deadline). If any surplus remains or those aren’t account types that support your goals, consider adding it to your current brokerage or creating a new one. In any event, ensure you leave yourself enough cash reserve. I’m happy to help if you’d like to talk about how to get it invested. We can review options like Betterment.com, target-date funds, or an advisory service.

- I have NO IDEA when this market will bottom. Timing the market is difficult and not advisable. If you’re tentative about throwing your whole enchilada into the market, try doing it over a period of time. IE) If you have $100k cash to get invested, throw $20k in over the next 5 weeks.

- Mortgage rates are fantastic right now. Reach out to your preferred broker to get a quote on refinancing or for rates if you’re looking to buy this spring/summer.

- Take an honest assessment of how you feel right now. Are you wanting to sell out of bonds to buy up more stock? Maybe you’re more aggressive than you thought. Are you feeling completely ill seeing your account balance drop? Consider reallocating to something more conservative once we get through this bout of turmoil so you’re better prepared for the next downturn.

- Enjoy time with your family if you’ve been relegated to your home. This may be a once in a lifetime situation (hopefully!) Take it for what it is.

- Stay away from elderly family or friends until this virus comes to a conclusion. Love them over the phone or email.

This Post Has 2 Comments

Great insights here to help you think about how to feel during these times of volatility. It also helps to think about the 10 20 year economic outlook to put these times in perspective.

Pingback: 4 Ways College Admissions Will Change Next Year - North Andover Financial Planner | Powwow, LLC