According the NRF, we are expected to spend $25.9 billion for Valentine’s Day in 2023. “Valentine’s Day is a special occasion to shop for the people we care most about,” NRF President and CEO Matthew Shay said. “This year, as consumers embrace spending on friends and loved ones, retailers are ready to help customers celebrate Valentine’s Day with memorable gifts at affordable prices.”

When we were in elementary school, most of us have fond memories of receiving cards and candy on every February 14th. We would bring a decorated shoe-box to school and by the end of the day, it would be filled with sweet notes from our classmates and lots of candy. And now as parents, you may have just helped 3 kids prepare at least 50 cards for their classes like me! The tradition roars on.

But how many of us knew then, or know now, the history of Valentine’s Day? Or how big Valentine’s Day business really is? Let’s explore.

A Muddled History of Valentine’s Day

The history of Valentine’s Day is shrouded in mystery – and some would say its origins are anything but romantic. But most historians agree that today’s holiday can trace its roots through both Christian and Roman history.

Many historians suggest that the ancient Romans are responsible for our modern Valentine’s Day because Emperor Claudius II executed two men – both happened to be named Valentine – on February 14th of different years in the 3rd century. Legend suggests that one of the Valentines, a priest, performed marriages in secret despite the fact Claudius had outlawed marriage for young men because he decided that single men made better soldiers than those with wives. When Claudius discovered that Valentine was performing marriages, he was put to death.

Other historians suggest that the Christian church may have decided to place St. Valentine’s feast day in the middle of February to “Christianize” celebration of Lupercalia, which was a fertility festival – as well as a pagan one – dedicated to the Roman god of Agriculture, Faunus.

The Business of Valentine’s Day

No matter your historical perspective, no one can argue that in 1913, Valentine’s Day forever changed when a Kansas City-based firm named Hallmark Cards began mass-producing Valentine’s Day cards.

And today, Valentine’s Day is huge business:

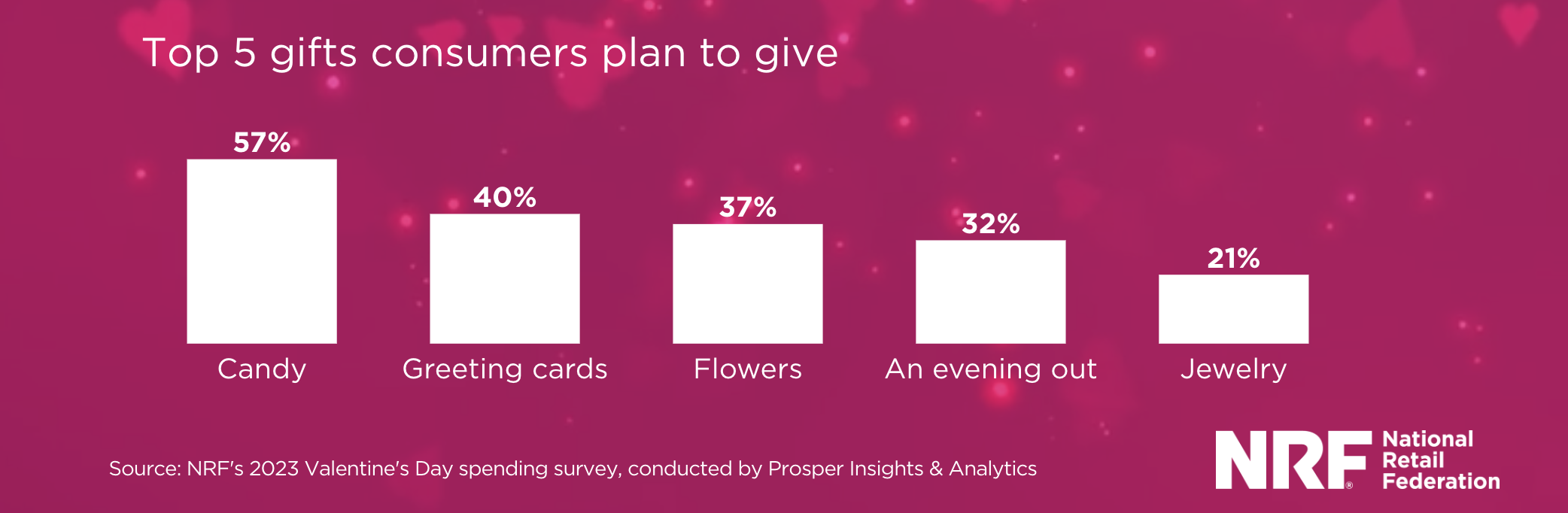

- According to the National Retail Federation, consumers in the U.S. will spend an estimated $25.9 billion on gifts for Valentine’s Day, up from $23.9 billion the previous year.

- The gift of an “experience” is trending higher this year. Not surprising given we’re celebrating the freedom to roam post-covid.

- Those aged 35 to 44 plan to outspend other age groups, allocating $335.71 on average for gifts and other Valentine’s Day items, approximately $142.91 more than the average consumer celebrating the holiday.

- Even among those who don’t plan to celebrate Valentine’s Day, 28% will still mark the occasion in some way, seeking non-Valentine’s gifts, treating themselves to something special or planning a get-together or evening out with single friends and family members.

Valentine’s Day & Financial Planning

So, you’re probably wondering, “what does Valentine’s Day have to do with financial planning?”

Well, I could suggest that the amount of money we spend each Valentine’s Day is reflective of the overall economy, much like Black Friday signifies the health of the upcoming shopping season. Or I could suggest that the $25.9 billion is a big part of our consumer spending, (but keep in mind U.S. GDP is about $23.32 trillion).

But truthfully, Valentine’s Day is simply something we need to consider as apart of our overall budget to ensure we can celebrate the holiday without panicking about the price.

Unsure what to get an adored elderly relative? Read my list of creative ideas.

Unsure how to factor Valentine’s Day into your budget? Learn how to manage large or irregular expenses right now!

Happy Valentine’s Day.

Adapted from FMEX Direct with permission.