I've paid in... now I want my pay out!

One of the most common questions for anyone planning for retirement is: “What’s the best age to start Social Security?” You’ve probably heard there are penalties for taking it early. Big increases for waiting. And even strategic exceptions when it comes to filing for spousal benefits.

Two things upfront:

- I’ve found the Social Security Administration is actually quite helpful with advising you on options if you’re able to get through to someone. But given most citizen’s experiences with interacting with government agencies (*cough* like dealing with the IRS right now *cough*) many of us would feel comforted with a third party opinion that knows our entire financial picture. Regardless, prior to filing I encourage anyone to make an ssa.gov account to periodically check their work history and estimated benefits.

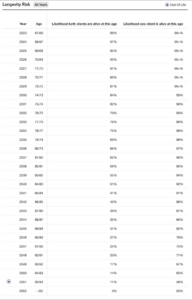

- Deciding upon the best age to start social security can amount to a lot of white noise when determining the success of a financial plan for any one person. But when simply looking at how to maximize the benefit (ie – by waiting), there are cost of waiting variables to consider that undercut, if not totally exceed, the reward (taxes paid on increased IRA distributions and pulling investment funds from the market). The real secret to maximizing your benefit is knowing how long you’ll live. But short of being diagnosed at 62 with a life threatening illness which makes the choice clear, it’s difficult to materially beat an actuary. Determining the best age to start social security is a matter of planning on contingencies and comfort level.

Is 62 years the best age to start social security?

Social Security roots it’s math in your “Full Retirement Age (FRA)” benefit amount. If you were born in 1960 or later, FRA will be considered age 67. If you take it sooner than this age, the earliest being 62 (or 60 if a widow), there are some things to watch out for.

- The benefit is permanently reduced by up to 30%, few exceptions apply.

- The benefit may be partially withheld if you’re still working. (Read more here)

Couples and Families have more to Consider

Your spouse may be eligible for a benefit based on your work record, and it’s important to consider Social Security protection for widowed spouses. Married couples around age 65 today have at least a 50-50 chance that one will live to age 95. If you are the higher earner and delay starting benefits, it will result in higher monthly benefits for not only the rest of your life, but for your widow’s as well should you pass first.

I’m often asked about the logistics of spousal benefits. The way I would best explain it is a couple is entitled to receive at least 1.5x the largest benefit while they’re both living. Let’s say Phil gets $3,000/mo and Claire gets $500/mo based on their individual work history. Claire’s benefit would pay out at $500 but would also be supplemented by another $1,000/mo off Phil’s record. This would bring them up to $3,000 + $1,500 (1.5x largest benefit).

If Phil died, she’d receive her $500 + $2,500 off Phil’s work history to receive the larger of the two benefits. But the extra $1,500 drops off entirely due to the death. She gets the largest, but not both.

For a couple on more equal footing, they’d each simply receive their own full benefit vs relying on a spousal supplement. That’s because their own record exceeds half the spouse’s benefit. Let’s say Mitch gets $3,000/mo and Cam gets $2,800/mo, Cam is better of taking his full $2,800 benefit than $1,500 of Mitch’s. However, in the past there were options to “file and suspend” and file a “restricted app” which maximized couple’s benefits.

You may have heard of these options and be wanting to do the same thing. For example, Cam could have taken half of Mitch’s early but then switched back to his own record at FRA or later. Unfortunately these strategies have been largely phased out. Those born in 1953 will be the last ones to use the restricted app option. File and suspend has already ended.

Your children may also be eligible for a benefit on your work record if they’re under age 18 or if they have a disability that began before age 22. This is important to remember within a plan before choosing the best age to start social security, especially when figuring out how much insurance to buy.