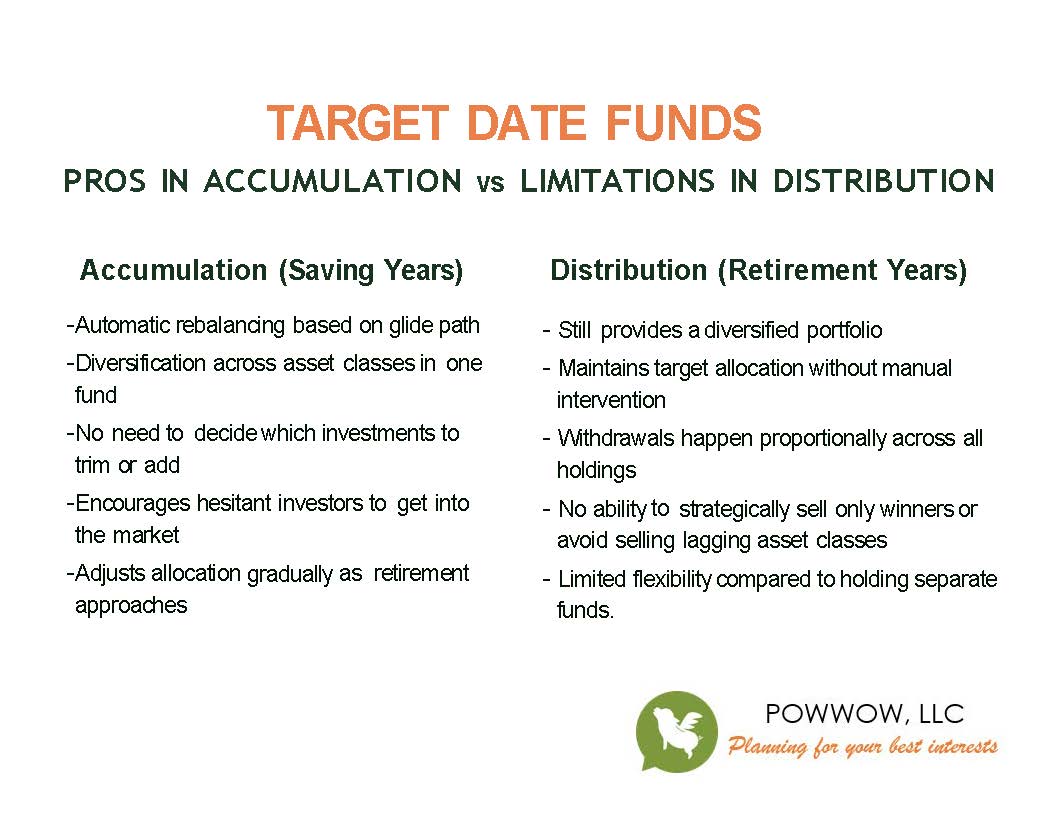

Target date funds have done a world of good for retirement investors, especially those who may have been hesitant to start. Target date funds simplify investing, encourage participation in the markets, and take advantage of long-term compounding without requiring the investor to constantly rebalance or strategize.

I’m a fan, particularly in the accumulation phase. But I also think they have limitations once retirement begins. Here’s my take on when they shine and when you might want to consider alternatives.

Why Target Date Funds Work Well in the Accumulation Phase

During your working years, it’s likely not necessary to hold a large collection of funds for strategic purposes. A target date fund manages the asset allocation for you, rebalancing periodically based on the fund’s glide path.

What target date fund managers review when rebalancing:

-

Market conditions and economic trends — Adjustments may be made based on interest rates, inflation, or recession risk.

-

Asset class performance — The fund might rebalance between equities, bonds, and other asset classes to maintain the intended risk level.

-

Glide path progression — As the “target date” approaches, the allocation gradually shifts from aggressive (more equities) to conservative (more bonds and cash equivalents).

-

Longevity and withdrawal assumptions — Managers model how much risk is appropriate given expected retirement length and spending patterns.

For investors not yet taking withdrawals, the fund automatically maintains balance and diversification. You don’t have to decide which holdings to trim, because you’re not generating cash flow—you’re simply investing for growth.

Why I’m Cautious About Target Date Funds during Retirement

Once retirement begins and periodic withdrawals (or required minimum distributions) start, things change. A target date fund still holds the same diversification, but you lose the ability to be strategic about which parts of your portfolio you tap for cash.

For example:

-

If international stocks are underperforming, you may want to avoid selling them while they’re down—letting them recover instead.

-

If U.S. equities are riding a hot streak, you might choose to sell some of those gains before a potential pullback.

-

If bonds are having a bad run due to interest rate hikes, you might prefer to pull from equities temporarily.

With a portfolio built from separate asset class funds, you can make those calls. A target date fund bundles it all together, so withdrawals happen proportionately, no matter the market environment.

Choosing the Right Target Date Fund

Here’s where I think many investors get tripped up: the “date” in the fund’s name is less important than the allocation inside it.

Target date funds often shift from aggressive to conservative in a short window of time. That might not match your risk tolerance or retirement timeline.

Examples:

-

If you’re young — The “right” date based on your age could have you 90–100% in equities. But if that’s too aggressive for your comfort, you could choose a fund with a nearer target date for a more balanced mix.

-

If you plan to work longer — Let’s say you’re 65 but still working for 10 more years. Your age-based target date fund might already have you in a 50/50 allocation. If you’re comfortable with more risk, you could choose a fund with a later date to increase your equity allocation to something more appropriate.

Tip: Be sure to look at the actual asset allocation, not just the year in the fund’s name. And revisit annually to ensure you’re not surprised by any glide path shifts.

Index vs. Actively Managed Target Date Funds

As many funds do, target date funds come in two main varieties, index-based and actively managed. The difference can impact both cost and performance. Index-based target date funds aim to track broad market benchmarks using passively managed underlying funds. They typically have lower expense ratios, which can be an advantage over decades of investing. Alternatively, actively managed target date funds give portfolio managers more discretion to adjust allocations, choose individual securities, and shift between asset classes based on market conditions. This flexibility can potentially add value or minimize risk during volatile periods, but it also tends to come with higher fees and the risk that active decisions may underperform the market. Whichever you choose, it’s important to understand not just the glide path and allocation, but also whether you’re paying for an active approach—and whether that aligns with your investing philosophy.

Don’t Forget Fees

While many target date funds are reasonably priced, some carry higher expenses—especially in certain employer retirement plans. As just mentioned, a target date may have higher fees if it’s actively managed, so that’s important to note to judge fairly. If the fees seem high (I’d argue 0.75% or more), it may be worth reviewing other target date options if available or reviewing the fund line up within the 401(k) to see if creating a custom portfolio makes more sense.

Why Target Date Funds May Not Be Ideal Outside a Retirement Account

Target date funds are designed primarily for retirement accounts, where taxes on investment gains and income are deferred until you withdraw funds. Outside of that environment, they may be less tax-friendly.

Here’s why:

-

Not built for tax sensitivity — Target date funds aren’t intended to minimize taxable events. They may aim to hold funds that generate regular interest and dividends, all of which are taxable in the year they’re paid.

-

Capital gain distributions — The fund managers may sell underlying holdings to rebalance, recognize gains, or change the allocation as the glide path progresses. These sales can trigger capital gain distributions, adding to your taxable income, even if you never sold a share yourself. Read here for how to prevent a year-end capital gains tax surprise.

-

“Good problems” with a cost — Earning interest, dividends, and realizing gains is a sign your investments are working, but in a non-retirement account, those events increase your annual tax bill. Inside a retirement account, whether that’s a 401(k), IRA, or similar, these tax consequences are not a factor while you’re accumulating. Taxes are only paid when you eventually take distributions, allowing all earnings to grow tax-deferred in the meantime.

Tip: If you like the simplicity of a target date fund but want to hold it in a taxable account, look for “tax-managed” or “tax-efficient” fund options—or work with Powwow to replicate the allocation using more tax-sensitive building blocks.

Bottom Line

Target date funds can be a fantastic tool for retirement savers—especially during the accumulation years. They help overcome inertia, encourage disciplined investing, and manage the details for you. But once you start taking distributions, you may want the flexibility to decide which parts of your portfolio to tap at any given time. Check out these top-rated funds from Morningstar.com. And consider their site a resource to help assess your target date and fund options.