If you’ve received a notice from Fidelity or Vanguard inviting you to participate in their securities lending program, you might be wondering if it’s a no-brainer way to earn extra income. On the surface, it looks simple—your shares are temporarily loaned to other investors, and you receive a small lending fee in return. But as with most things in investing, the details matter.

How the Program Works

When you participate in a securities lending program, your stocks or ETFs are made available for borrowing—typically by traders looking to “short” the market. In the case of the leading custodians, Vanguard and Fidelity handle the process: they find borrowers, collect collateral (usually more than the value of your loaned shares), and return your securities once the loan ends.

You continue to see your holdings in your account, but behind the scenes, your shares are circulating temporarily in the financial system.

The Upside: Modest but Effortless Income

The benefit is straightforward—you receive a slice of the lending fee. That fee can vary depending on how in-demand your shares are. If you own a stock that’s popular with short-sellers, the income might be noticeable. But for most investors, the yield is relatively small—often just a few extra dollars per year on every $10,000 in stock value.

It’s “found money,” but not game-changing.

The Hidden Risks

Even though custodians offering the program take steps to protect investors, there are trade-offs worth noting:

Counterparty exposure: If a borrower defaults, the custodian uses collateral to cover your position. The system works most of the time, but no safeguard is foolproof.

Loss of voting rights: While your shares are on loan, you give up the ability to vote in shareholder elections. For investors who value corporate governance or environmental/social votes, this can matter.

Tax treatment: This is the big one. If a dividend is paid while your shares are on loan, you receive a “payment in lieu of dividend”—taxed as ordinary income rather than a qualified dividend. That higher tax rate can easily offset the extra income from lending.

Also, keep in mind the bigger picture of what’s happening. The surge in demand for your investment which makes this worth doing, can temporarily put downward pressure on the stock’s price as more shares are sold into the market. Meaning – you’re making money on the loan but your investment is losing value, which can be scary. However, if those short-sellers are proven wrong and the stock’s price climbs, the rush to buy back borrowed shares can drive the price up sharply in what’s known as a “short squeeze.” In either case, securities lending demand often signals elevated volatility rather than a change in the company’s fundamental value. Over time, the stock’s performance still comes down to business results—not borrowing activity. But be prepared to see some volatility if the investment is in demand for the program.

When it Makes Sense – and When It Doesn’t

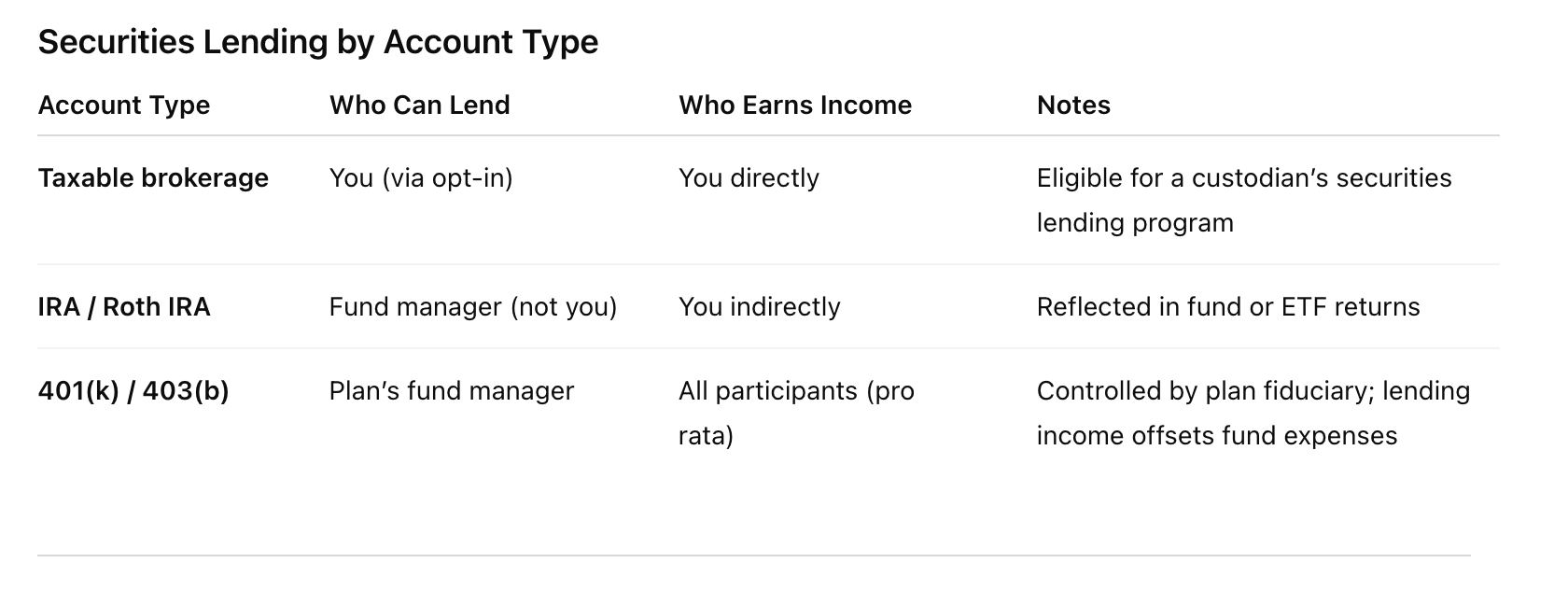

If you hold these positions inside an IRA or 401(k), securities lending can make sense. Taxes aren’t a factor there, and you’re already investing for long-term growth. That said, dissapointly it’s not typically offered on these types of accounts for individual investors.

In a taxable brokerage account, however, the math is less favorable. The combination of ordinary-income taxation and the small incremental benefit can mean the risk and complexity outweigh or water down the reward.

Final Thoughts

Securities lending can be a smart tool in the right situation, but it’s not truly “free money.” For most long-term investors, especially in taxable accounts, it’s more of a curiosity than a meaningful wealth-builder.

Before enrolling, weigh the potential lending income against what you might give up in taxes and voting power. If you’re unsure, talk it through with your advisor to decide if this quiet corner of investing fits your broader plan.

Quick Take:

Extra income potential

Minimal operational hassle

Some hidden tax and voting implications

Watch out for:

-

“Payments in lieu” taxed at higher rates

-

Temporary loss of voting rights

-

Modest income unless you hold in-demand stocks