This year reminded us why investing isn’t about chasing headlines, it’s about building a plan that works across all kinds of markets.

Here’s what really mattered in 2025:

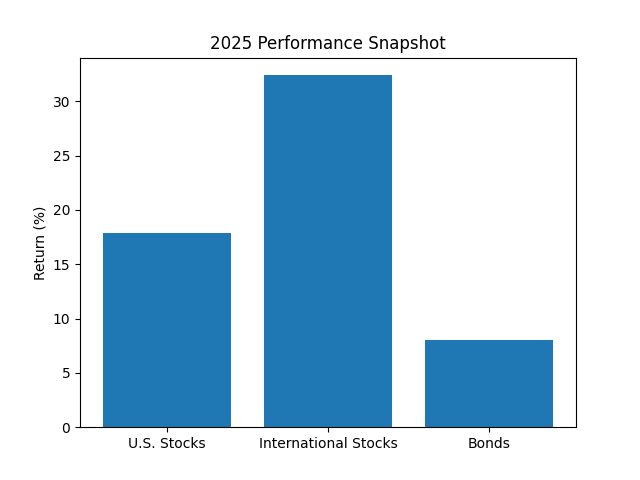

U.S. stocks did well, but most of the gains came from a small group of big tech and AI-driven companies.

International stocks quietly had one of their strongest years in a long time, rewarding investors who stayed globally diversified and didn’t simply invest 100% into the SP500.

Bonds came back. For the first time in years, they’re providing real income — not just stability. After a long stretch of near-zero interest rates, high-quality bonds are once again pulling their weight inside portfolios.

Small-company stocks have long been a favorite place to “tilt a little extra,” with the hope that today’s smaller businesses become tomorrow’s big success stories. Small caps had a good year in 2025, but they weren’t the top performers — larger U.S. companies and international markets won out.

Lessons Learned:

High money market rates made “doing nothing” feel as productive as bond investing for a while. Now that money market rates are cooling and bonds are stepping back into their traditional role, it may be time to think about getting excess cash invested.

This year showed that diversification works, even when one part of the market gets all the attention.

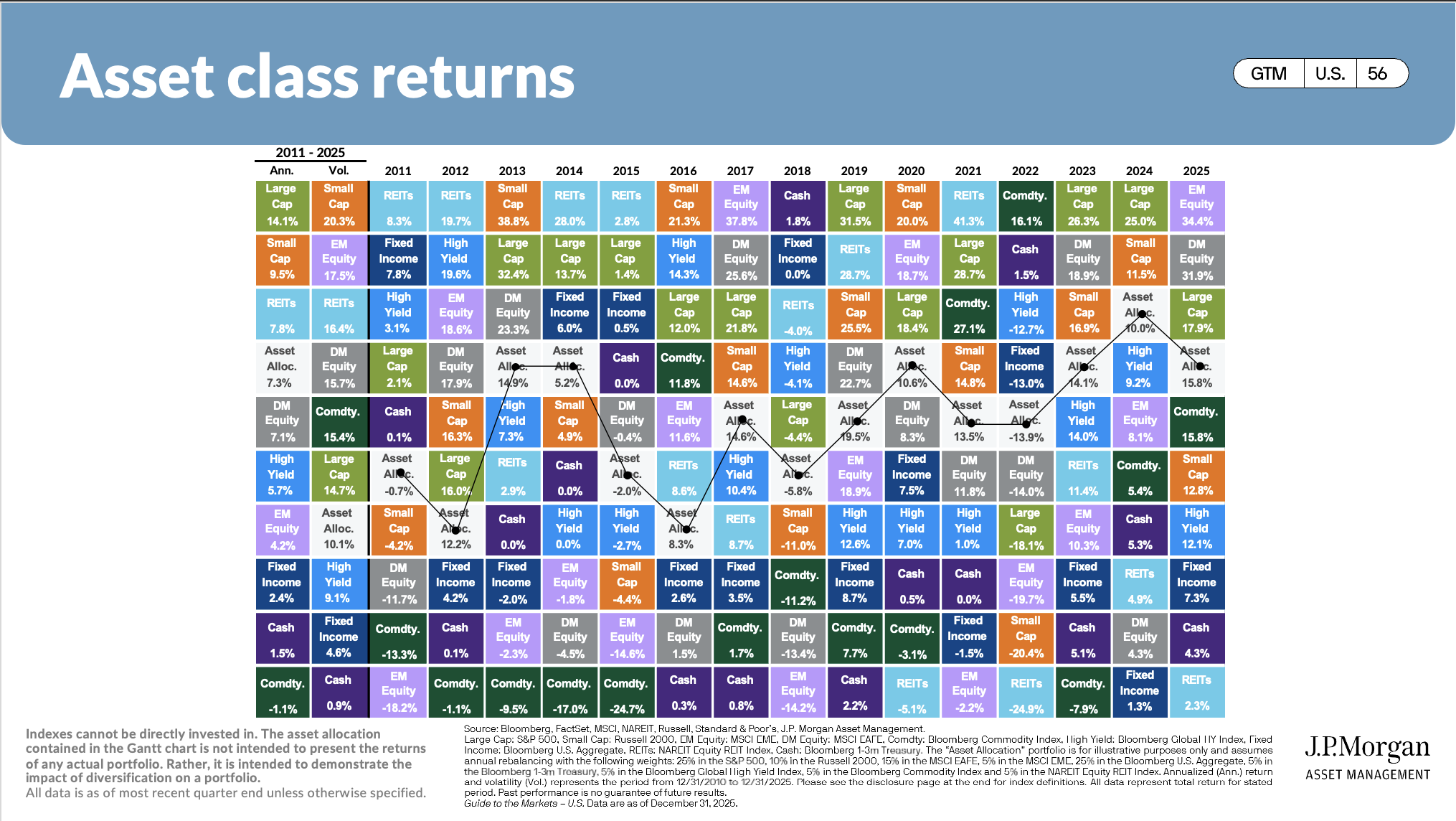

It’s tempting to chase whatever investment is winning right now, but this quilt shows why that rarely works. Each row is a different year. Each column is a different type of investment. The colors jump all over the place.

The market doesn’t move in straight lines. Leadership changes constantly.

This is why your portfolio is built like a quilt, not a single fabric. Owning many different pieces helps smooth the ride, reduce regret, and keep your plan intact even when headlines feel unsettling.

If you have questions about how these trends impact your personal plan, I’m always happy to walk through it with you.