The FDIC was designed for moments like this

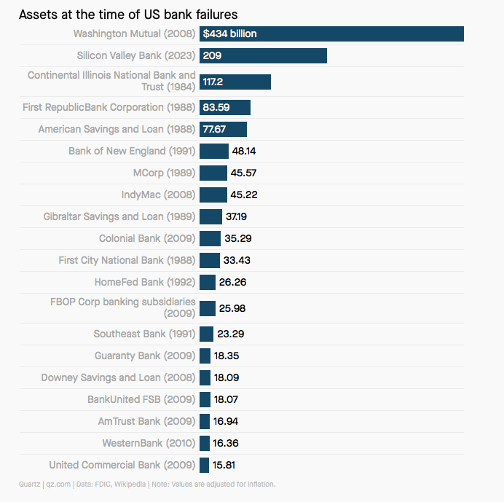

The FDIC-seizure of Silicon Valley Bank is the second-largest US bank failure in history as it held $209 billion in assets at the time of its collapse. Even after adjusting for inflation, by assets it trails only Washington Mutual, which held $434 billion in assets when it failed in 2008.

The Silicon Valley Bank failure rocked the tech industry and sent tremors throughout Wall Street as it largely serves start-ups and venture capitalists. Those with deposits at the bank – namely start-up founders and venture capitalists – worried that money needed to pay employees is frozen or worse, lost.

And while the failure of Silicon Valley Bank is troubling, given their unusual deposit-base and unique shortcomings, it is unlikely that we will see a run of bank failures any time soon. But did you know that bank failures and collapses have been a part of the financial landscape for centuries?

In fact, it is not at all unusual for at least a few U.S. banks to fail in any given year. Just over 2 years ago Almena State Bank closed. Fortunately, it was backed by the FDIC. This is not to say that Silicon Valley Bank’s failure should be dismissed as inconsequential, because its failure will continue to ripple through the banking system and through Wall Street for some time. But it’s also important to maintain perspective.

The FDIC

Throughout history, there have been numerous instances of banks that were unable to meet their financial obligations, resulting in the loss of depositor’s money. In the United States, the Federal Deposit Insurance Corporation (FDIC) was created in response to the Great Depression of the 1930s, which saw the failure of over 9,000 banks.

The FDIC is an independent agency of the federal government that provides insurance to depositors in case their bank fails. The creation of the FDIC was a direct response to the widespread bank failures that occurred during the Great Depression. In those days, depositors had no protection, and if their bank failed, they stood to lose all their savings. The FDIC was created to restore confidence in the banking system and to provide a safety net for depositors.

How Deposit Insurance Coverage works

The FDIC is funded by premiums paid by member banks, and it guarantees deposits up to a certain amount. The current limit is $250,000 per depositor, per insured bank. This means that if a bank fails, the FDIC will step in and ensure that depositors get their money back, up to the insurance limit. Keep in mind investments, including mutual funds and money market funds, are not covered by FDIC insurance. It’s designed for bank deposit accounts, such as checking, savings, money market accounts, and certificates of deposit (CD).

Do you have various accounts types? Watch the video below or click here to read in more detail the amount of FDIC insurance coverage you may be entitled to.

Since its creation in 1933, the FDIC has played a vital role in maintaining stability in the banking system. It has insured trillions of dollars in deposits and has helped to prevent bank runs and panics. While there have been bank failures since the FDIC’s creation, the number has been significantly lower than before.