Long-term care services under Medicaid in Massachusetts, known as MassHealth, are available for eligible individuals who require assistance with activities of daily living (ADLs) and meet the program’s eligibility criteria. Long-term care services can be provided in various settings, but most popularly associated with nursing homes.

Community-based programs aimed to help low-income seniors often use the same or similar eligibility requirements as MassHealth, and may provide certain long-term care services at the home or within assisted living. The Frail Elder Waiver, PACE, and various Veteran’s programs come to mind. Here’s an overview of how to receive long-term care under MassHealth:

Eligibility:

Eligibility for long-term care services under MassHealth is primarily determined by income and asset limitations, as well as the need for long-term care services.

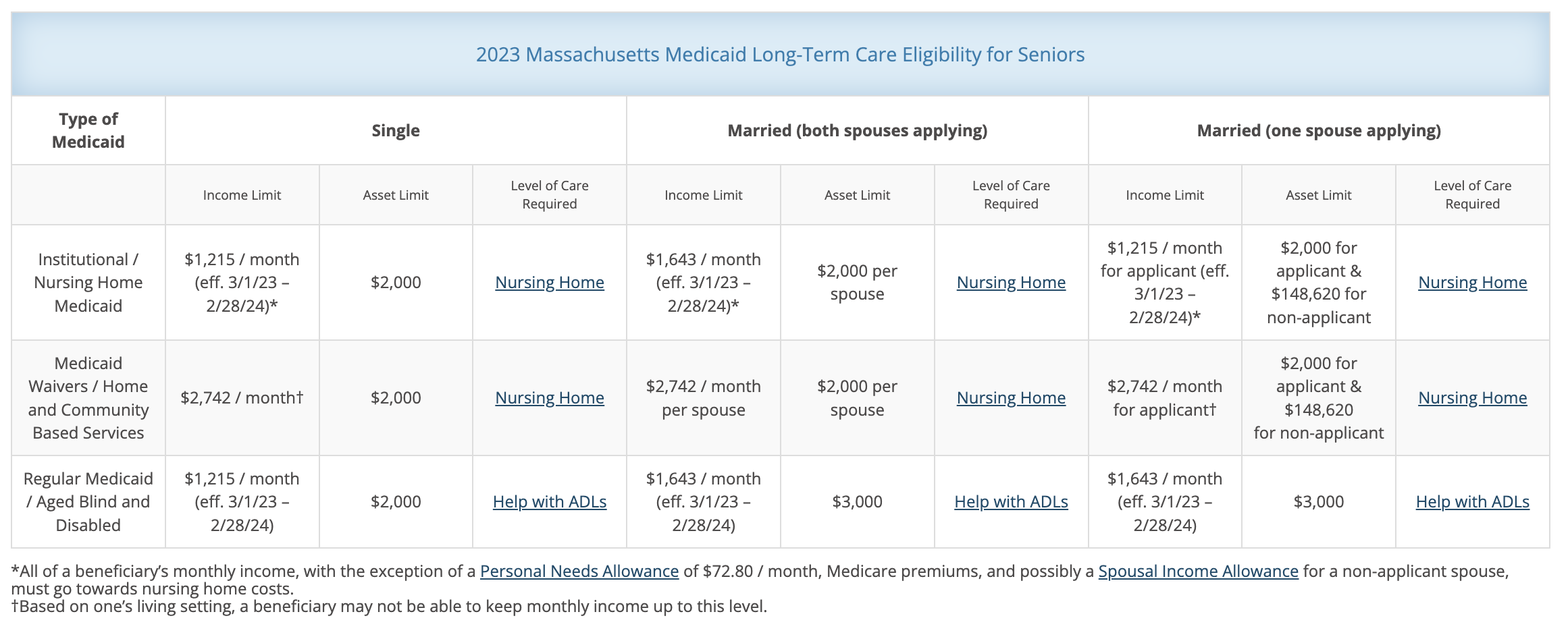

- Applicants must meet specific income and asset limits, which can vary depending on the program and whether they are applying as a single individual or a married couple.

- There are spousal protections in place to prevent the impoverishment of the spouse who does not need long-term care. These protections aim to ensure that the non-applicant spouse can maintain a certain level of income and assets. A married applicant where only one spouse is applying for long-term care generally has the most opportunity for strategic Medicaid planning to help protect net worth against the costs of care.

- Applicants must have certain medical conditions where a level of care is required. The need for assistance with activities of daily living (such as bathing, dressing, eating, and mobility) and memory loss are all key factors in determining medical eligibility.

- Applicants must meet specific income and asset limits, which can vary depending on the program and whether they are applying as a single individual or a married couple.

Application:

To apply for MassHealth’s long-term care services, you can do so through Mass.gov, or with the help of a professional. The application is where financial eligibility is determined. Be armed with the applicant’s social security number, proof of income, and recent statements or policies to support the information provided on the application.

I find that the application process is where families or applicants quickly realize they may be ineligible for services because they well-exceed asset requirements (this is not hard to do!) Individual applicants must spend down to $2,000 excluding their primary residence. Married couples can have $2,000 in the applicant’s name and about $148,000 in the well spouse’s name. And in the worst case scenario of both spouse’s applying, only $3,000 between the two is allowed. While it’s not considered gifting to reposition assets between spouses (therefore not triggering the well-known 5-year look back), it can be tricky and time-consuming to accomplish when there are multiple accounts, multiple custodians, and a heavy concentration of retirement accounts. You can’t simply move a retirement account to a spouse’s name without a significant tax consequence. Learning about the ins and outs of financial eligibility as you prepare to fill out the application is where questions spring up about what’s considered countable assets, how to strategically spend down assets, etc. So who answers these questions?

Generally, families turn to elder law attorneys for help on the matter, largely because they’re in search of ways to protect net worth that exceeds eligibility requirements by utilizing an irrevocable trust, gifting strategy, or immediate annuity. The options to protect net worth vary given the time horizon before care is needed, asset type, family dynamics, and whether the person needing care is single or married. If you’re considering an attorney, you may have met Patrick Curley at one of my past panel events. Patrick is a certified elder-law attorney here in Massachusetts and could be a great resource.

If you’re not in a position to consider an irrevocable trust to protect net worth, or simply don’t want to go down that road, your best bet may be to work with a dedicated application professional. In my area, Silver Lining Solutions is a company that solely focuses on filing applications. They also have the ability to implement certain asset protection strategies, such as using an immediate annuity, and advise on efficient spend-down, such as pre-paying a funeral.

If you’re already in the nursing home and have or will shortly run dry of funds. The nursing home will want you to spend down what you have available toward care, but will likely offer to file an application on your behalf for free. They may do this work in-house to the best of their ability, or outsource to a contracted professional as discussed above (but on their dime.) This is offered to ensure timely payment to cover the cost of care once private-pay funds have been depleted.

Utilizing a professional vs a DIY or last-minute approach can quickly alleviate a lot of confusion related to the application and expedite the process. From my perspective, many family members haven’t been fully clued in on the applicant’s finances and therefore spend a great deal of time tracking down accounts and finding recent balances. They’re also not sure of how to treat certain assets, such as life insurance cash value and death benefits, cars, and old boats. And that’s understandable – it’s very confusing! A professional or attorney will be able to address those questions and recommend how to report/re-title/dispose of these kinds of assets. Professionals are also able to gather account information via banking authorizations that search via a person’s social security number vs the family having to paw through old paper statements.

You’re approved!

If you are eligible for nursing home care, MassHealth will help cover the costs of care in a nursing facility that participates in the MassHealth program. If searching for a community already enrolled on Medicaid, it can be difficult to “get your butt in a bed,” as I put it. So it may make sense to enter a nursing facility as a private-pay resident and apply for Medicaid soon after.

If you prefer to receive care in your home or a community-based setting, MassHealth offers various Community-Based Services programs. These provide a range of services, including personal care assistance, homemaker services, adult day health programs, and more. You can work with a MassHealth representative or self-selected advocate to develop a care plan tailored to your needs, and services will be provided accordingly.

Ongoing Eligibility:

Eligibility for MassHealth long-term care services must be periodically reviewed to ensure that the individual’s needs and circumstances have not changed. It’s crucial to note that MassHealth rules and eligibility criteria may change over time, so it’s advisable to consult the official MassHealth website for the most up-to-date information and assistance with the application process. Additionally, you may want to consider seeking guidance from the discussed Medicaid planning specialists or elder law attorneys who can provide tailored advice based on your specific situation.