Open enrollment is here, so as I offer every year, here is my latest recap that goes over the different Medicare plan coverage options and their costs:

Part A Hospital Insurance:

There is no premium to people (and usually their spouses) who’ve paid into Medicare for 40 quarters, and you would have automatically enrolled upon turning 65. If you’ve put in less than 40 quarters, you can buy into the program. For 2025, there is a $1,676 “benefit period” deductible for a hospital stay (an increase of $44 from 2024), which is often misinterpreted to mean annual. A period begins the day that you enter a hospital. Once you are discharged from the hospital and do not receive care for a continuous 60 day period, the period officially ends. If another health event occurs, you’ll be responsible for another $1,676 deductible. There is also a daily co-insurance when remaining in the hospital beyond 60 days ($419/day through day 90). You also receive 60 lifetime reserve days (they seem to love the number 60). These are capped at $838/day during periods of hospitalization.

Skilled care has a separate co-pay system. Days 1-20 are covered, 21-100 bills $209.50/day to the patient, anything beyond 100 will be fully charged to the patient. For reference, private pay skilled care at a long-term care community is around $500/day depending on the room and location.

Part B Medical Insurance:

There are three levels of cost with this plan: annual deductible ($257), co-insurance (~20%) and monthly premium (starting at $185 in 2025). The monthly premium is sometimes forgotten by seniors as it’s typically deducted from your Social Security. However, if you’re a recent retiree holding off on social security you’ll be paying this amount directly. The premium can vary for a few reasons:

- You pay an ongoing penalty for not enrolling during your seven-month window when turning age 65.

- You may qualify for assistance, thereby lowering your premium.

- Your tax return reports MAGI higher than $106,000 (single filer) or $212,000 (married filing jointly), causing you to pay a higher premium as shown in the 2025 IRMAA chart below *click to expand.* Being aware of these limits may allow you to better plan throughout the year to stay under these thresholds if possible

You may also notice a new premium table that may or may not apply to you. Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare plan coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. For 2025, the immunosuppressive drug premium starts at $110.40/month. For more information on this specifically, read on here.

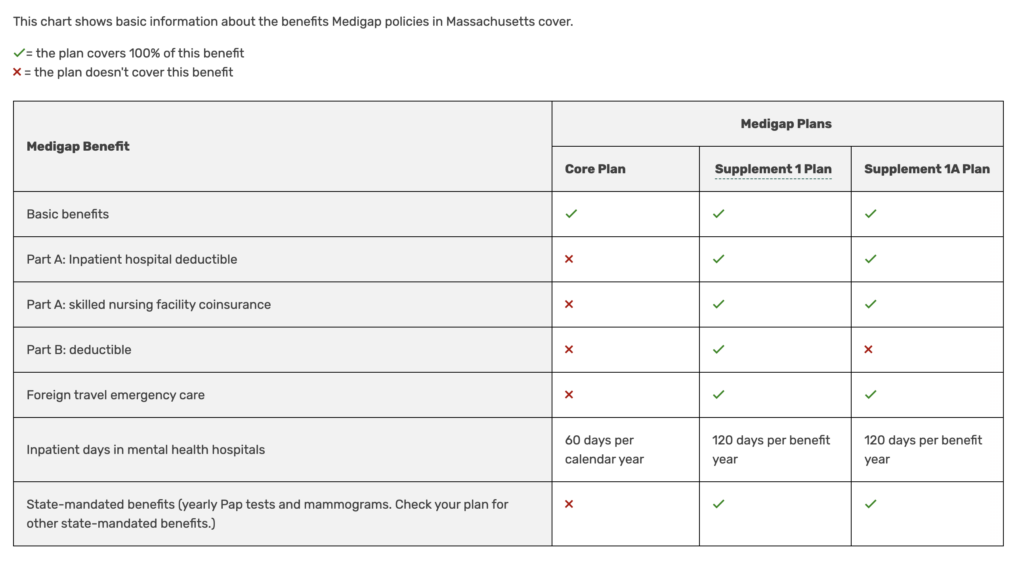

Medigap and Plan 1 Supplements (optional):

Chart:

https://www.medicare.gov/health-drug-plans/medigap/basics/compare-plan-benefits/massachusetts

A supplement attempts to fill in the gaps and extend coverage beyond Part A and B plans. If you’re not sure what I mean by gaps, consider the revolving Part A $1,676 deductible as an example. With a Plan 1 or 1a supplement, you’ll receive nationwide coverage and won’t have the concern of being “in-network.” The cost among insurers for Plan 1 and 1a varies despite the fact that all providers are offering the same coverage as required by law.

There are 3 main differences between Plan 1 and 1a to keep in mind:

- Availability: Plan 1 is only available to those who turned age 65 prior to January 1, 2020. Therefore, it is not available to new Medicare enrollees and is phasing out.

- Coverage: The difference in coverage is simply the Part B deductible. Plan 1a requires you pay that initial $257 deductible whereas Plan 1 kicks in immediately.

- Premium: I’ve noticed the premium for Plan 1 can be a good $600 more per year. Given that, it doesn’t make sense to pay $600 more per year for $257 of extra coverage. I anticipate this will accelerate grandfathering the Plan 1 option.

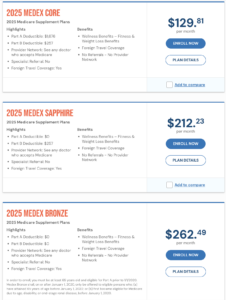

Alternatively, MA also offers a core option, which has large gaps in coverage that likely dwarf any savings in premium. An example of this can be seen when comparing Blue Cross Blue Shield Medex Bronze, Sapphire, and Core options for 2025. Go to this site to plug in your own zip code to see pricing. I’ve done a screen shot to the left as an example for my zip.

Alternatively, MA also offers a core option, which has large gaps in coverage that likely dwarf any savings in premium. An example of this can be seen when comparing Blue Cross Blue Shield Medex Bronze, Sapphire, and Core options for 2025. Go to this site to plug in your own zip code to see pricing. I’ve done a screen shot to the left as an example for my zip.

Part D Prescription Insurance (optional – sort of):

Plans now average to about $55 a month, may include co-pays, and have a deductible of no more than $590 for 2025. The deductible usually only comes into play if you’re using brand-name medication. Thanks to the Inflation Reduction Act of 2022, out-of-pocket costs will be capped at $2,000 starting 2025. This ends a complicated system of having to understand donut hole and catastrophic coverage as we’ve seen in the past.

Medicare has also negotiated a cap on specific drugs, such as $35 for insulin, to help those insured from even needing to reach these high levels of out-of-pocket spending. More caps are in the works, see this press release to find out if your prescription is on the list. Also new are free vaccines. While many were already covered (like the flu), more have been added to the list (like Shingles).

Other things to consider are late enrollment penalties and income-related increases to premium, both similar to what’s done with Part B coverage. What’s very important to keep in mind is that covered prescriptions and co-pays may alter within the plan year-to-year. It’s critical to evaluate each year whether your plan is still the best option. Click HERE to learn about enrollment agents that can help.

Advantage Plans (optional):

An Advantage Plan is a private insurance that takes the place of everything described above; however, you’ll still pay the Part B premium separately. Some people enjoy the convenience of working with just one insurance provider, especially since the prescription plan is included. It resembles an HMO or PPO, meaning you’ll want to ensure your preferred doctors are in-network and remember that you may need referrals to see specialists. The monthly premiums are likely less than the Plan 1 or 1a Supplement, but you’ll also be responsible for co-pays and possibly co-insurance, which potentially makes this the more expensive option if you have a health event.

So what are the financial implications for an average person enrolled in the Plan 1 supplement that utilizes generic prescriptions?

Part A: $0

Part B: $2,220 ($185/mo premium)

Plan 1 or 1a Supplement: $2,880 (assuming a $240/mo premium)

Part D: $900 (assuming $55/mo premium and $20/mo generic co-pays)

Total: $6,000/year or $500/month

This Post Has 2 Comments

Pingback: The Best Way to Choose a Plan During Medicare Open Enrollment Season - Powwow, LLC

Pingback: Understanding Medicare IRMAA Brackets and How to Plan Early - Powwow, LLC