Rising college costs and inflationary pressures are hurting parents and kids

Many parents are preparing to send children off to school this fall. While the checklists grow and the kids soak in the last few minutes of summer break, it’s important to remember the tuition fee schedule and back-to-school shopping may be more expensive this year.

And while getting through the curriculum itself can feel overwhelming, paying for it can seem nearly impossible. And living in New England means I’m not just approached with helping families plan for college, but private K-12. So the cost of tuition and everything directly related to school – think books, room and board, fees, and transportation – can certainly exceed well beyond 4 years of college.

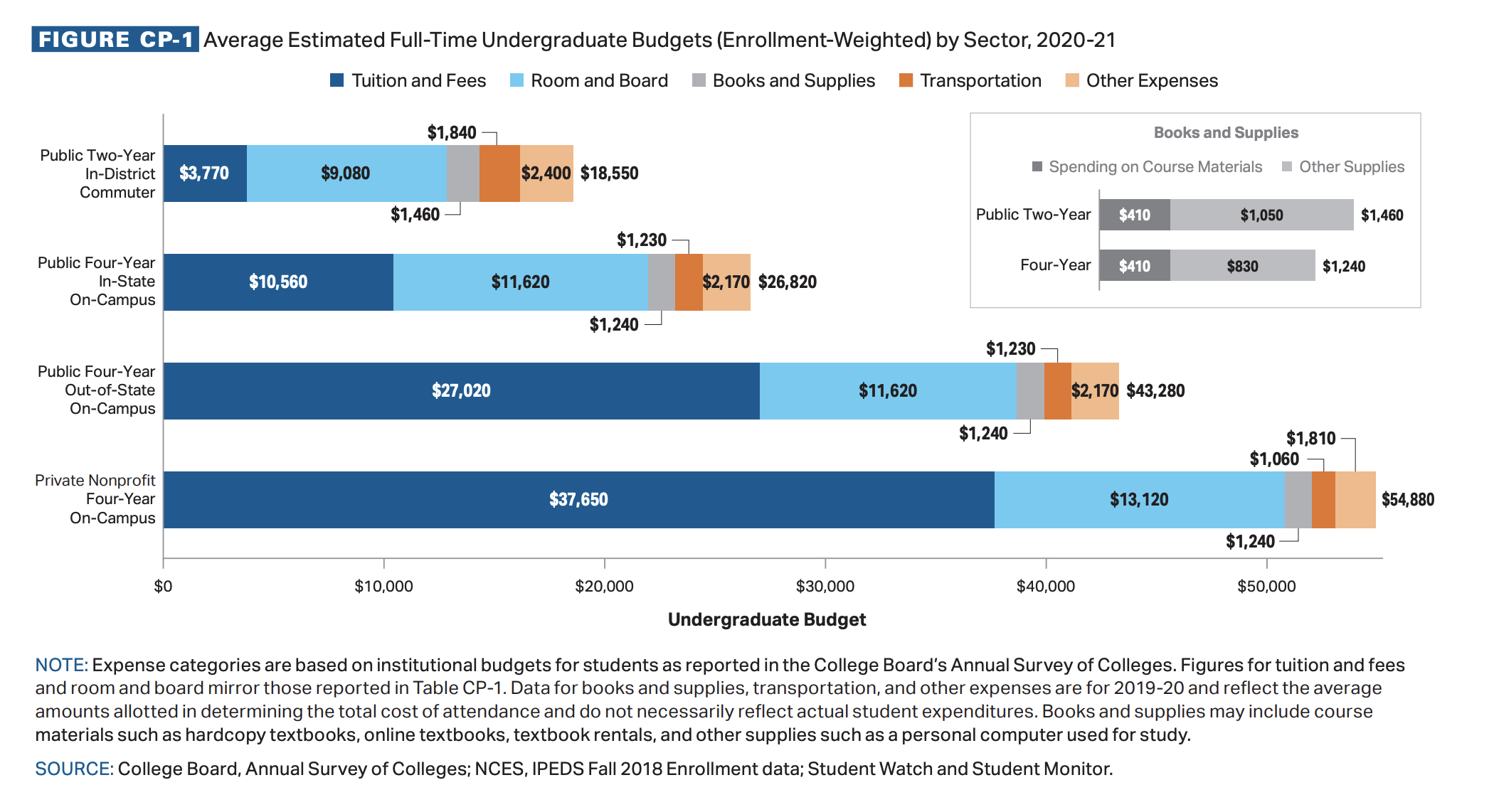

So what are costs looking like for 2021? For example, average expenses related to college for the 2020-21 academic (pandemic) year increased to $26,820 for in-state students at four-year public colleges, according to the College Board. And the same expenses at four-year private institutions rose to $54,880. With the Delta variant spreading and CPI inflation, the 2021-22 school year is set to be that much worse. See the full breakout for last year below:

Think about a 529 Plan

How should you start saving? Think about a 529 plan for starters. The money you put away in a 529 plan grows tax-free as long as you use it on education. Also, depending on your state, you might be eligible for a state income tax credit of 20% of contributions to a 529 account, up to a certain amount per year. In MA it’s pretty stingy in my opinion, with just a $1,000 deduction for single filers and $2,000 deduction for couples.

Another great benefit of a 529 is the donor retains control of the account and makes the decision for when withdrawals are made and for what reason, unlike a UTMA account. If you over-save for one child and not enough for another (ie – one child doesn’t attend private high school or college whereas another continues onto grad school) the account beneficiary can be easily changed to a sibling, kept and rolled over to a grandchild, or distributed with taxes and a 10% penalty due on just the capital gains.

Concerned about annual contribution limits to the 529 like we see with IRAs and 401(k) plans? Don’t be. Many 529 plans allow for $500,000 per beneficiary to be held in a 529 account, but it’s important to know your state’s limits. Massachusetts, for example, caps contribution limits at $500,000 whereas New Hampshire maxes out at $350,000. But your balance can still grow past that amount through investment returns without limit. So save away!

Back-to-School Costs are Up (Inflation)

As mentioned, it’s not JUST the cost of tuition that makes us sweat. Parents are budgeting for their kids’ books, supplies, technology, and flights (if attending a non-local school).

According to a recent Online Shopper Intelligence survey, one in three respondents will spend more than they did last year on back-to-school shopping – and last year was a very strange year for schooling. School supplies will make up 78% of purchases, while 64% of shoppers also plan to buy clothing.

But inflation is making it more expensive this year. In fact, according to the National Retail Federation, the typical family with children in K-12 this past year spent about $850 on school supplies – a new record. That was up 7% from last year, when COVID shut down many schools forcing parents to spend more for remote classes. But parents’ costs for shopping for this coming school year are up a whopping 22% when compared to the costs from the most recent pre-pandemic school year.

A Teaching Moment for Kids

The best way to “plan ahead” for your children’s education isn’t just about saving enough. For many it’s about setting expectations early. Doing so can prevent dashing dreams when acceptance letters roll in. A mix of savings, strategic income planning during FAFSA years (which yes can even be K-12), and setting expectations on what can be afforded can be a winning combination to get through the cost of education.

Also, don’t discount that back-to-school season is a great time to teach children and young adults about budgeting and giving priorities to certain purchases. Fold your child into the bigger picture conversation rather keeping conversations related to education just about homework, sports and what’s for lunch.