Question: What are the best ways to manage your child’s cash gifts effectively?

- Piggy Bank: Some people enjoy the visual appeal of a full piggy bank. While quaint, it’s not secure from siblings, loss, or damage. I’d keep the piggy for change and $1 bills. Anything more should be directed to a more secure location.

- Certificates of Deposit (CDs): Bank CDs offer the safety of principal and guaranteed returns. However, interest is subject to tax and current rates are generally low. You’ll also have to keep track of the maturity date so it can be rolled over into a new CD or something else entirely. This may be a convenient placeholder for a parent to use for a very young child, but wouldn’t be my long-term recommendation. Same idea applies to a savings or treasury bond.

- Uniform Transfers/Gifts to Minors Act (UTMA/UGMA): If you’re wanting to open a basic account for your child this avenue is your best bet. An added bonus is that you, the parent, are kept in the loop until they reach the age of majority (21 in Massachusetts.) Initially, the child may just be depositing nominal gifts, but later your child can add direct deposit for earnings from an after school job. It’s also a good opportunity and platform to teach them the value of investing. There are no penalties for using the funds on expenses unrelated to college, which is great for kids saving toward multiple goals (laptop, school trip, car, general spending money.) Again, this is a great account to hold money received or earned by a child. There may be better options if you are planning to use your own money to save on behalf of a child.

- Roth IRA (child’s name): If opening in the name of a child, which makes sense given that it’s their money, your contribution to the account will be limited by their earned income. If their only income comes from doing chores they will not be able to contribute to an account in their own name. However, for example, if they’re earning reportable income as a cashier at the local grocery store they’ll be able to contribute the lesser of their earnings or $7,000/year.

- Roth IRA (parent’s name): If opening in the name of a parent, you’ve likely determined that the child doesn’t have any earned income to open an account of their own. In my opinion, this option makes the most sense when a parent is trying to save their own money (not the child’s money) toward future goals. Potentially the parent has $7,000/year to save ($8,000 if aged 50+) and they’re not sure how they want to prioritize retirement and education goals. Instead of debating the issue now, they can save into a Roth and decide later how the account can be spent. This account also works best for those in mid to lower tax brackets.

- UPLAN Prepaid tuition:

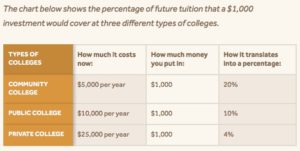

Chart provided by MEFA.org This is a unique program that allows participants to “lock in” tuition rates at eligible state colleges or universities with a lump-sum investment or monthly installment payments. Instead of investing, your rate of return is essentially equal to compound inflation at the school your child attends. In Massachusetts, the program works with about 7o in-state schools, ranging from Bunker Hill Community College to Boston College. If the child doesn’t pick a school on the list the plan can be rolled to a family member or cashed out with nominal interest and no penalty to the parent.

- UFUND College Savings: programs allow contributions to grow tax-free and be applied at any accredited institution of higher education nationwide. Some states also allow the added bonus of tax-deductible contributions. Massachusetts recently started offering a $1,000 state income deduction for single filers and $2,000 for married filers if using a MEFA Fidelity 529. At a 5% tax that’s worth $50-100 in tax savings. In a nutshell, you’re simply not paying tax on investment growth if it’s spent on education. The UFund is far more popular than the UPlan, however, the onus is on you to invest the account which has the potential to lose money in a down market. Also, if a child decides not to pursue higher education, the funds can be rolled to a family member or cashed out with a 10% penalty on the earnings (not the whole account.) Lastly, I don’t often see children engage with the 529 accounts and investment options are limited. This means if it’s not your intention to have Susie pay for college with birthday cash, the UPlan and UFund are not your best option.

- Trusts: This is a reasonable option if your child is receiving larger gifts to the extent that safeguarding the money trumps using the account as a teaching tool. A common example is a grandparent making the max annual exclusion gift ($18,000/year) to each grandchild. Putting this money in trust would allow the parent the ability to name a successor trustee (in the event the parent(s) passed away) and outline uses for the money, which may include a home purchase, business start-up, health, education, and general welfare. These trusts are especially useful for older children that have proven to be spendthrifts or have substance abuse issues. Trusts are also useful for special needs children, however, there are two specific types that would be used for these circumstances so the child isn’t disqualified from receiving state aid. The only downside of a trust is there is a cost to create it, however, it’s marginal if the intent is to safeguard a large sum of money.

This Post Has 4 Comments

The U.Fund plan does allow a state tax deduction for MA residents – $1k for single persons and $2k for married couples filing jointly.

https://www.fidelity.com/go/529-Massachusetts/overview

Yes, true! Since this piece was published that tax incentive came out. I plan to update this shortly to reflect recent changes to that and a few other tidbits. Thanks for the Fidelity link!

Pingback: Dodge Toys and Boost College Savings - North Andover Financial Planner | Powwow, LLC

Pingback: Time's Up! Paying for College - North Andover Financial Planner | Powwow, LLC