Welcome! Did you find us because you’re…

- Feeling financially insecure about spending thousands a month on elder care?

- Overwhelmed with information coming from seminars, care providers and salesmen?

- Experiencing family conflict and frustration over how best to move forward?

You're Looking to Achieve

Healthier Relationships

Less Stress

When life gets complicated we tend to carry too much. Learn what to keep and what to delegate. Time is your family’s greatest asset, spend it wisely.

Confidence in Your Decision

Confidence comes from understanding your options and their expected outcomes. Elder care financial planning helps to weave together relevant and factual information alongside reasonable assumptions so you can make a better decision. Cut through the noise and get answers that matter to you.

Awesome! Let’s Powwow for Elder Care Financial Planning.

Flexible Virtual Portal

Collaborative environment so you don’t need to leave home or work for meetings

Find out how much aging-in-place is really costing you with our spending tool

Safely store and share your most important documents in the vault

Additional log-ins available for family and trusted professionals

The Elder Care Planning Process

Step 1: Onboard. Review paperwork, pay invoice, and create your new eMoney portal. Start now!

Step 2: Schedule your first Powwow with our convenient virtual calendar.

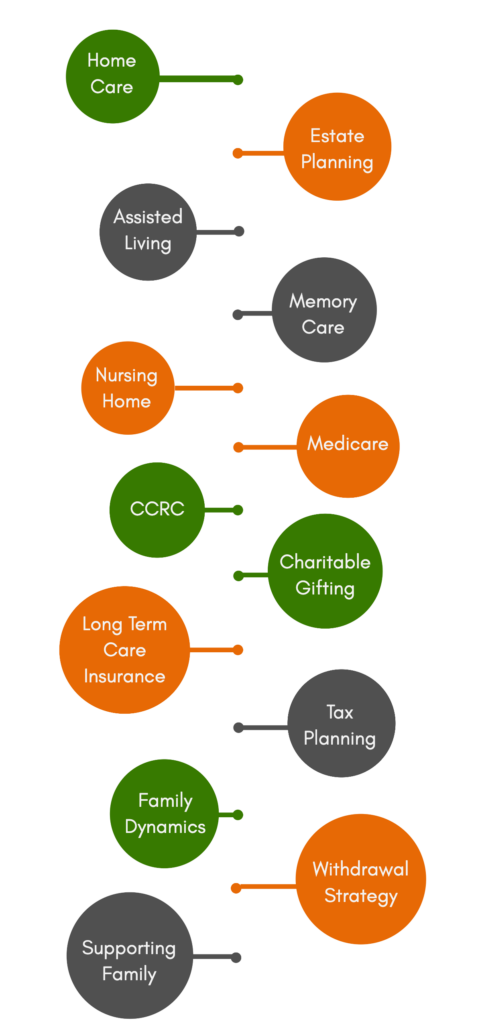

First Powwow: Determine available care options

We will discuss the different levels of care to help you decide how best to move forward for yourself or loved one. Care options are determined by eligibility, which are directly tied to finances and health. This conversation is also an opportunity to discuss the emotional side of transition. Our elder care financial planning provides guidance and perspective to make conversation within the family more productive and less contentious.

Second Powwow: Visualize affordability and strategy

“What if…” is a phrase we hear a lot. If you’re deciding between various communities or styles of care, this is your opportunity to see the affordability of each path. Our elder care financial planning performs this analysis we can begin determining strategic spend down from available accounts and policies. We’ll also determine the feasibility and timeline for strategic estate planning, immediate annuities, PACE program, Veteran’s Aid and Attendance, and local community programs.

Third Powwow: Plan delivery

Your plan is complete and we have addressed family dynamics, delegating responsibilities, and a financial plan that illustrates your chosen care path with a list of recommendations. After plan delivery you’ll have access to eMoney for the remainder of the year. If you would like to retain ongoing advisor access please ask about our membership program.

FAQs

Our elder care financial planning gives the freedom to complete plans at the client’s pace, which is driven by their availability to provide information and complete powwows. On average, plans generally take 10-15 hours to complete, but this is just an estimate.

Our elder care financial planning services require project and membership clients to pay a preferred hourly rate of $330. Projects have a minimum of 10 hours. Memberships have a minimum of 8 hours/year. Those not committed to a project or membership pay the hourly rate of $380.

Quentara Costa is a fee-only Certified Financial Planner™. We do not draft estate planning documents, prepare taxes, sell annuities or insurance, or work for community elder service programs. Powwow, LLC is not a health care professional or care provider. If deemed beneficial to pursue advanced strategies, care, or benefits, additional professionals can be hired at the client’s discretion. If local, Quentara can provide recommendations for independent health assessments, attorneys, CPAs, Medicare enrollment, real estate agents specializing in senior downsizing, move managers, handymen, and retirement community locators. National recommendations will be made when possible and with insight from affiliated elder care and financial networks. Quentara does not receive any referral fees or commissions if making a recommendation to a trusted professional.

It is perfectly fine to provide hard copies of requested information. However, the time it takes to scan and manually enter data will add time to the project and increase the cost.