Open enrollment is here, so as I offer every year, here is my latest recap that goes over the different Medicare Part/Plan options and their costs:

Part A Hospital Insurance:

There is no premium to people (and usually their spouses) who’ve paid into Medicare for 40 quarters, and you would have automatically enrolled upon turning 65. If you’ve put in less than 40 quarters, you can buy into the program. For 2022, there is a projected $1,556 “benefit period” deductible for a hospital stay (up from $1,484 in 2021), which is often misinterpreted to mean annual. A period begins the day that you enter a hospital. Once you are discharged from the hospital and do not receive care for a continuous 60 day period, the period officially ends. If another health event occurs, you’ll be responsible for another $1,556 deductible. There is also a daily co-insurance when remaining in the hospital beyond 60 days ($389/day through day 90 – projected). Skilled care has a separate co-pay system. Days 1-20 are covered, 21-100 bills $194.50/day (projected) to the patient, anything beyond 100 will be fully charged to the patient.

Part B Medical Insurance:

There are three levels of cost with this plan: annual deductible ($217 projected), co-insurance (~20%) and monthly premium (starting at $158.50 projected). The monthly premium is sometimes forgotten by seniors as it’s typically deducted from your social security. However, if you’re a recent retiree holding off on social security you’ll be paying this amount directly. The premium can vary for a few reasons:

- You pay an ongoing penalty for not enrolling during your seven-month window when turning age 65.

- You may qualify for assistance, thereby lowering your premium.

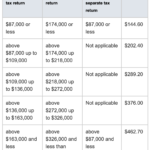

- Your tax return reports MAGI higher than $87,000, causing you to pay a higher premium as shown in the 2020 IRMAA chart above *click on the thumbnail to expand.* Being aware of these limits may allow you to better plan throughout the year to stay under these thresholds if possible

Plan 1 Supplement (optional):

A supplement attempts to fill in the gaps and extend coverage beyond Part A and B plans. If you’re not sure what I mean by gaps, consider the revolving Part A $1,556 deductible as an example. With a supplement, you’ll receive nationwide coverage and won’t have the concern of being “in-network.” The cost among insurers varies despite the fact that all providers are offering the same coverage as required by law. You may also encounter the “Core Supplement” with a more attractive price tag. Core has three large gaps in coverage that dwarf the +/- $80 a month savings as compared to “Plan 1.” Another thing to keep in mind is that with Plan 1 (aka Plan F in states other than MA) you pay a single monthly premium and no co-pays, co-insurance or deductibles related to Part A or Part B coverage. This makes accounting for healthcare within a fixed budget far more predictable.

Part D Prescription Insurance (optional):

Plans are typically +/- $35 a month, may include co-pays, and have a deductible of no more than $480 for 2022. The deductible usually only comes into play if you’re using brand name medication. For people that aren’t able to use generics, the “donut hole” has been an issue, however, as of 2020 this coverage gap has been addressed differently. As of 2021, once you reach $4,130 in prescription costs, the patient is then responsible for 25% of the ongoing costs until they reach $7.050 of out-of-pocket expenses. At that time catastrophic coverage kicks in with only a 5% copay or $3.95 for generics and $9.85 for brand-name drugs (whichever is greater). Catastrophic coverage means you’ve met the plan’s out-of-pocket limit for covered drugs so you will only pay a marginal co-insurance or copayment for the remainder of the year. Other things to consider are late enrollment penalties and income related increases to premium, both similar to what’s done with Part B coverage. What’s very important to keep in mind is that covered prescriptions and co-pays may alter within the plan year-to-year. It’s critical to evaluate each year whether your plan is still the best option. Click HERE to learn about enrollment agents that can help.

New for Medicare Part D plans are options that comprehensively cover diabetic patients. This directly addresses concerns about insulin becoming overly expensive. These plans cost no more than $35/month.

Advantage Plans (optional):

An Advantage Plan is a private insurance that takes the place of everything described above; however, you’ll still pay the Part B premium separately. Some people enjoy the convenience of working with just one insurance provider, especially since the prescription plan is included. It resembles an HMO or PPO, meaning you’ll want to ensure your preferred doctors are in-network and remember that you may need referrals to see specialists. The monthly premiums are likely less than the Plan 1 Supplement, but you’ll also be responsible for co-pays and possibly co-insurance, which potentially makes this the more expensive option.

So what are the financial implications for an average person enrolled in the Plan 1 supplement that utilizes generic prescriptions?

Part A: $0

Part B: $1,902 ($158.50/mo premium)

Plan 1 Supplement: $2,580 (assuming a $215/mo premium)

Part D: $660 (assuming $35/mo premium and $20/mo generic co-pays)

Total: $5,142/year or $428.50/month

This Post Has 3 Comments

Pingback: Medicare Open Enrollment Season - North Andover Financial Planner | Powwow, LLC

Pingback: 2 Pieces of Savings Advice to Reconsider - North Andover Financial Planner | Powwow, LLC

Pingback: Understanding Medicare IRMAA Brackets and How to Plan Early - North Andover Financial Planner | Powwow, LLC